We are not eliminating all of our tech holdings but have scaled out of numerous positions and will likely continue to do so with others. There are still tech positions that we like and will continue to hold such as Apple and Google

Greeks go back to the elections polls this Sunday in order to determine if they will follow through with austerity plans or go the opposite route which could lead to their exit from the Euro. What makes this continued saga important in our view is how does the European Union handle the possible exit of one it's countries?

Although Greece represents only a tiny sliver of the overall European GDP and world GDP for that matter, it is the domino effect it's exit could have on the rest of the continent. When one country defaults on it's debts what prevents the next company from defaulting and so forth. Suddenly things can go from very bad to extremely worse.

It is this concern that has made us reconsider our current holdings and strategy. We would much rather preserve our capital and risk less assets in the face of this uncertainty. This shift in strategy does not means that we are going all cash but we are reducing our asset holdings and increasing our cash reserves.

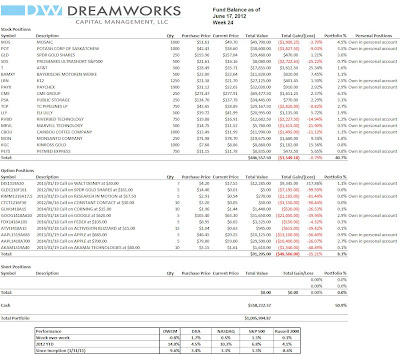

Below is a recap of our market activities for the week

- Exited Positions

- PROSHARES ULTRASHORT 20+ YEAR - exited this position as more people seek the safety of bonds which of sending bond yields lower and prices higher

- EBIX

- Fortinet

- Fushion IO

- Lowe's call options, expire in July

- Boston Beer Company call options, expire in September

- Added Positions

- TC Pipelines LP - we believe that Master Limited Partnerships offer good protection in this uncertain investment environment with a solid dividend return and limited to no European exposure

The Week Ahead

There is a limited amount of economic data scheduled to be released this week. However that doesn't mean there will be less market action. Monday and Wednesday are the major event days this week with the Greek elections Sunday night which will drive trading action Monday. On Wednesday you have Bernanke and company with the FOMC announcement and press conference. At that point we will get a better feel if there will be an additional QE program or possible extension of "operation twist" in which the fed buys longer dated bonds in an effort to drive rates.

- Mon - Greek election results, Housing Market Index, DWCM finance Seminar

- Tue - Housing Starts

- Wed - FOMC Meeting Announcement

- Thu - Jobless Claims, PMI Manufacturing Index Flash, Existing Home Sales, Philadelphia Fed Survey, FHFA House Price Index, Leading Indicators

- Fri - N/A

Also on Monday June 18th is the first quarterly finance seminar presented by DreamWorks Capital Management LLC. The seminar, "401k & 403b Rollovers, You have Options", will discuss the array of investment options you have when it comes to retirement. The seminar is being held at The Community House located in Birmingham, MI. The event is free and you can register by calling TCH at 248-644-5832 or you can email me directly at pfenner@dwcmllc.com. We hope that you will consider this great event and learn more about the services we offer here at DWCM.

Have A Great Week and Happy Father's Day on Sunday to all of the fathers out there!

No comments:

Post a Comment