This is a rather troublesome piece that 60 Minutes featured a few weeks ago regarding your credit in America. Mistakes in your credit score occur far more often than one might imagine But even if you detect the errors, trying to correct them as the piece below explains is a whole different ballgame.

What was enlightening to us is that the credit report/score that you can purchase on your own from one the the 3 major firms, can be vastly different than the one a company uses to determine your credit worthiness.

Wednesday, February 20, 2013

Monday, February 18, 2013

Jeremy Grantham on Investing in a Low-Growth World

You never know where Jeremy Grantham, head of GMO, quarterly newsletter will appear. This past quarter for Q4 2012 appeared front and center in the editor's section of Barron's. I have also enclosed a link to a PDF version here located on the GMO website.

As usual Grantham's newsletters are always extremely insightful but can also get quite lengthy. Below is a few bullet points that we took away from his piece this quarter.

As usual Grantham's newsletters are always extremely insightful but can also get quite lengthy. Below is a few bullet points that we took away from his piece this quarter.

- For there to be a stable equilibrium, assets, including entire corporations in the stock market, must sell at replacement cost. If they were to sell below that, no one would invest and instead would merely buy assets in the marketplace cheaper than they could build themselves until shortages developed and prices rose, eventually back to replacement cost, at which price a corporation would make a fair return on a new investment, etc.

- The history of market returns completely supports this replacement cost view. The fact that growth companies historically have underperformed the market – probably because too much was expected of them and because they were more appealing to clients – was not accepted for decades, but by about the mid-1990s the historical data in favor of "value" stocks began to overwhelm the earlier logically appealing idea that growth should win out. It was clear that "value" or low growth stocks had won for the prior 50 years at least.

- In the meantime for us at GMO it means emphasizing care and maintaining a heightened sense of value discipline, not only in stock selection, as the whole world is once again bid up over fair value in a way so typical of the post 1994 era, but also in forestry and farmland. GMO has investments in those areas too and recognizes the need to sidestep overpricing by emphasizing the nooks and crannies. Fortunately there are more nooks and deeper crannies in forests and farmland than there are in almost any other area, certainly including stocks.

- When one combines the apparent determination and influence of those who do the bullying with the career risk and short-termism of the bullied and the desire of the general public to believe unbelievable good news, these overpricings can go much further and the Fed can win another round or two. That's the problem. A clue to timing would be when we begin to hear more passionate new era arguments: profit margins will always be higher; growth will snap back to 3% for the developed world; and new ones I can't think of … maybe "when the discount rate is this low the Dow should sell at, perhaps, 36,000." In the meantime, prudent managers should be increasingly careful. Same ole, same ole.

Saturday, February 16, 2013

2013 Week 7 Performance.....Finishing where we started

Three of the four major indices finished just about where they started this week. The only diverging index was the broad based Russell 2000 which finished higher by 1%. The S&P 500 barely kept it's positive weekly winning streak alive for 2013 with a 0.01% gain.

The VIX, which measures volatility finished under 13 which really indicates a subdued markets as far as volatility is concerned. Although markets were roughly flat for the week, this doesn't mean that there wasn't much movement. The DJIA had about a 150 point range between it's high and low of the week.

With the mandatory budget cuts only a week week away...again, people are likely just sitting back watching how things are going to play out. Many of the stocks that did move this week were ones that reported their earnings.

Buffalo Wild Wings BWLD, (a name that we own in the TAMMA Fund and our own personal portfolio) reported strong growth for the quarter and the full year despite the rise in chicken prices.

![[Chart]](http://wsj-us.econoday.com/showimage.asp?imageid=24023)

The VIX, which measures volatility finished under 13 which really indicates a subdued markets as far as volatility is concerned. Although markets were roughly flat for the week, this doesn't mean that there wasn't much movement. The DJIA had about a 150 point range between it's high and low of the week.

With the mandatory budget cuts only a week week away...again, people are likely just sitting back watching how things are going to play out. Many of the stocks that did move this week were ones that reported their earnings.

Buffalo Wild Wings BWLD, (a name that we own in the TAMMA Fund and our own personal portfolio) reported strong growth for the quarter and the full year despite the rise in chicken prices.

- Sally Smith, President and Chief Executive Officer, commented, "We achieved a 37.8% increase in revenue for the fourth quarter as a result of strong same-store sales of 5.8% at company-owned restaurants and 7.4% at franchised locations, 62 additional company-owned locations in 2012, and incremental revenue from our fourteenth fiscal week. For the year, our total revenue exceeded $1 billion, a new milestone for Buffalo Wild Wings! High cost of sales continued in the fourth quarter, offsetting some of the bottom-line benefit of the fourteenth week, resulting in net earnings growth of 22.3% for the fourth quarter and 13.6% for the year."

The stock dropped on the news but rebounded throughout the rest of the week to finished up 1% for the week.

We also noted that we were following Archer Daniels Midland (own in personal account) who reported solid results in the previous week (see here for details). ADM finished higher in the week by over 4% due to reports that Warren Buffet had taken a stake in the company.

Gold Miner Kinross Gold Corp (own in TAMMA Fund and personal account) finished 4% lower on the week after it reported a wider loss than expected on better than expected revenue. The concern here is that prices to mine gold are rising faster than anticipated.

These are just a few examples of the names we were keeping a close on eye this week, but bottom line, it is becoming more of a stock pickers market where all stocks are not moving in the same direction either up or down. Which is a good situation for us at TAMMA.

Initial jobless claims caught our attention this week. See below the positive commentary by Econoday

- Initial and continuing claims are at their lowest levels of the recovery and are pointing to building strength for job growth. Initial claims fell 27,000 in the February 9 week to a 341,000 level that is nearly 20,000 below the Econoday consensus. The four-week average, at 352,500, is about 10,000 below the month-ago trend which offers an early indication of strength for the February employment report. Next week's report, which will offer data on the survey week of the monthly employment report, will provide a more telling indication.

Another data point we were watching this week was retail sales. Given the increase in the payroll tax that affects every working American, we surmise that this data source will tell us how big this tax impact is having on people. The number for January was actually quite decent with the actual number matching the consensus estimate of a gain of 0.1%. We believe that February and March numbers will be more telling of the tax impact.

The Week Ahead

This is a shortened trading week in the US with markets closed on Monday in observance of President's Day. The rest of the week has some solid economic data points mostly surrounding the housing market. The housing recovery does not seem to be loosing any steam. And as the employment situation continues to gain traction, this could keep the momentum in the housing segment going as well. We are continuing to hold our own short position of a basket of home builders. We will likely let this strategy ride until the spring and make a determination then as to it's future.

- Mon - Markets closed for President's Day

- Tue - Housing Market Index

- Wed - Housing Starts, Producer Price Index

- Thu - Consumer Price Index, Jobless Claims, PMI Manufacturing Index Flash, Existing Home Sales, Leading Indicators

- Fri - N/A

Have a great week!

TAMMA Capital - Our Mission

TAMMA Capital LLC is an investment management firm dedicated to being a responsible steward of our clients’ assets, and helping them to achieve their investment and life style goals.

TAMMA’s Strategic Investment Advantage

At TAMMA, we buy individual securities and specialized ETF’s. TAMMA is less expensive than most mutual funds even though we create a personalized, tailored portfolio for each client. Our entire focus is on doing what is best for our clients. In addition, TAMMA

- Personally select assets to build customized client portfolios

- Is an independent RIA which allows for increased flexibility to utilize multiple investment options

- Has the ability to manage all of a client’s investable assets including brokerage, retirement, 401k, and business accounts

The TAMMA Value Chain

TAMMA strives to provide value to individuals and small/medium sized businesses. Key components include:

- Return on Investment (ROI)

- Peace of Mind

- Quality Network of Professionals

- Turnkey Solutions

- Business Operational Solutions

TAMMA Capital LLC is a Registered Investment Advisor (RIA) in the State of Michigan

Thursday, February 14, 2013

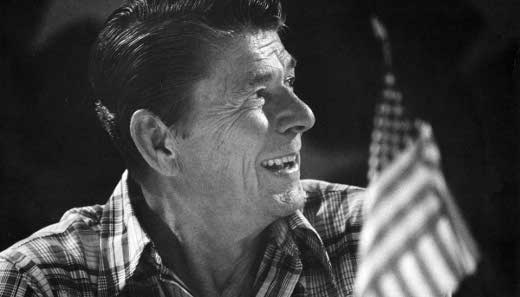

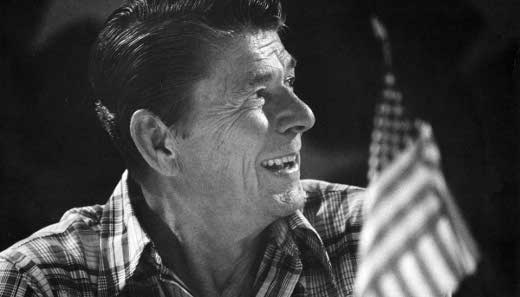

Happy Valentine's Day via Ronald Reagan

I had originally posted this piece regarding the personal life of former President Ronald Reagan in September of last year. I thought that it was very fitting to post again given that today is Valentine's Day.

It has been well documented in a series of letters and books the relationship that President Reagan had with his wife Nancy. The two shared some type of love and connection that would make any couple envious.

In a letter to his son Michael, the night before he was to marry, the President wrote the following letter courtesy of the website Letters of Note.

It has been well documented in a series of letters and books the relationship that President Reagan had with his wife Nancy. The two shared some type of love and connection that would make any couple envious.

In a letter to his son Michael, the night before he was to marry, the President wrote the following letter courtesy of the website Letters of Note.

- There is no greater happiness for a man than approaching a door at the end of a day knowing someone on the other side of that door is waiting for the sound of his footsteps.

(Source: Reagan: A Life In Letters; Image: Ronald Reagan, via.)

Tuesday, February 12, 2013

Yahoo January Traffic Growth Topped Google

According to Susquehanna Financial and ComScore, U.S. Internet traffic was up 1% year-over-year in January, slightly better than the flat year-over-year growth rate last month. The big shocker was that Yahoo unique visitors was up 5% year-over-year vs. a 2% increase at Google.

See Full Barron's article here

See Full Barron's article here

Monday, February 11, 2013

Day Trading Apple and Other Investment Tales

This is a good post at Barron's that shows you how the varying investment thesis' can be so different person by person. The article makes some very good points surrounding Apple's current strangle hold on some markets and the dominance of their ecosystem. I own a few Apple products and love them. However when it came time to buy a new computer last year, I originally bought a MacAir but after a week using it, I decided that the learning curve just wasn't worth it. Instead I bought a similar Lennovo ultra weight laptop that I really like. However, I have had nothing but problem with it.

Saturday, February 9, 2013

2013 Week 6 Performance.....Not even a Blizzard can stop these markets

I imagine many people in the northeast are either beginning to dig themselves out from the giant storm that has taken place over the past few days or even some are continuing to wait it out. Here in the Midwest where we reside, the snow totals were only about half of what was expected.

Nonetheless, nothing can seem to stop these equity markets from pushing higher. The S&P 500 capped it's 6th winning week in a row and has yet to see a down week so far this year. Just about everyone is waiting for some type of pull back which has yet to happen. This may indicate the higher the rise, the harder the fall.

The broader based Russell 2000 index which includes many smaller market cap companies, continues to lead the way as far as performance is concerned this year. Out of the four major indices that we track, the Russell is leading the pack with a return of 7.6%.

The TAMMA Fund had a difficult week due to the continued out performance of Netflix. This is one stock that has quite a bit of momentum behind it. We are still standing behind our call that the company is severely overvalued and will eventually come back down to earth.

Apple showed signs of strength this week despite being in the limelight as famed hedge fund manager David Einhorn of Greenlight Capital, suggested that the company needs to do more with it's cash position. Einhorn reportedly owns between 1.3M and 1.5M shares of Apple. We particularly liked a discussion we heard on Bloomberg Friday morning with The Big Picture's Barry Ritholtz.

Ritholtz's point was who knows more about what to do with Apple's cash than Apple. He went on to suggest that just because the company has retreated in price the past two quarters does not make it a damaged company. People weren't telling Apple what to do on the way up so why are people trying to tell them what to do now given a lower stock price? We completely agree with Ritholtz while we also continue to stand behind out current long Apple positions.

Moving on from Apple, a sector that continues to perform well this year and is part of our long-term strategy are the agriculture companies. Currently we own Mosaic, Monsanto, Terra Nitrogen, and Lindsay. We are also following equipment maker Agrium, but are hesitant to take a position given the run in the stock over the past 12 months. However, any signs of a pullback we would be buyers of this company.

There was a mixed bag of economic data released this week. The big stunner was the drop in productivity which showed a decline of 2%. This drop supports the lower GDP number for Q4 reported last week. Some of this could be attributed to the uncertainty caused by the fiscal cliff as companies pulled back not knowing what to expect. Initial jobless claims continued to slow and steady march lower which has to be seen as a positive.

The Week Ahead

Another light schedule of economic data lies ahead of us this week. Again, look for individual company earnings report to drive stocks. We will be specifically watching Buffalo Wild Wings, Kinross Gold, and Archer-Daniels Midland.

Have a great week!

TAMMA CapitalI wanted to thank everyone who attended our business book club review of “The Power of Habit: Why We Do What We Do in Life and Business” by Charles Duhigg at The Community House in Birmingham this past week. We had a great turnout of approximately 35 people. For those of you who could not attend or are interested in learning more about the book, please email us for a "Guide to Changing Habits" by the author as well as an outline of our discussion.

During the past few weeks, you may have noticed that we have not been writing as many posts as we typically do. Our focus over the past few weeks has been working on the redesigned website that we hope to launch within the next week. We appreciate everyone's understanding and we look forward to bringing you continued great content once this project is complete.

Nonetheless, nothing can seem to stop these equity markets from pushing higher. The S&P 500 capped it's 6th winning week in a row and has yet to see a down week so far this year. Just about everyone is waiting for some type of pull back which has yet to happen. This may indicate the higher the rise, the harder the fall.

The broader based Russell 2000 index which includes many smaller market cap companies, continues to lead the way as far as performance is concerned this year. Out of the four major indices that we track, the Russell is leading the pack with a return of 7.6%.

The TAMMA Fund had a difficult week due to the continued out performance of Netflix. This is one stock that has quite a bit of momentum behind it. We are still standing behind our call that the company is severely overvalued and will eventually come back down to earth.

Apple showed signs of strength this week despite being in the limelight as famed hedge fund manager David Einhorn of Greenlight Capital, suggested that the company needs to do more with it's cash position. Einhorn reportedly owns between 1.3M and 1.5M shares of Apple. We particularly liked a discussion we heard on Bloomberg Friday morning with The Big Picture's Barry Ritholtz.

Ritholtz's point was who knows more about what to do with Apple's cash than Apple. He went on to suggest that just because the company has retreated in price the past two quarters does not make it a damaged company. People weren't telling Apple what to do on the way up so why are people trying to tell them what to do now given a lower stock price? We completely agree with Ritholtz while we also continue to stand behind out current long Apple positions.

Moving on from Apple, a sector that continues to perform well this year and is part of our long-term strategy are the agriculture companies. Currently we own Mosaic, Monsanto, Terra Nitrogen, and Lindsay. We are also following equipment maker Agrium, but are hesitant to take a position given the run in the stock over the past 12 months. However, any signs of a pullback we would be buyers of this company.

There was a mixed bag of economic data released this week. The big stunner was the drop in productivity which showed a decline of 2%. This drop supports the lower GDP number for Q4 reported last week. Some of this could be attributed to the uncertainty caused by the fiscal cliff as companies pulled back not knowing what to expect. Initial jobless claims continued to slow and steady march lower which has to be seen as a positive.

The Week Ahead

Another light schedule of economic data lies ahead of us this week. Again, look for individual company earnings report to drive stocks. We will be specifically watching Buffalo Wild Wings, Kinross Gold, and Archer-Daniels Midland.

- Mon - N/A

- Tue - NFIB Small Business Optimism Index

- Wed - Retail Sales, Import and Export Prices, Business Inventories

- Thu - Jobless Claims

- Fri - Empire State Mfg Survey, Industrial Production, Consumer Sentiment

Have a great week!

TAMMA CapitalI wanted to thank everyone who attended our business book club review of “The Power of Habit: Why We Do What We Do in Life and Business” by Charles Duhigg at The Community House in Birmingham this past week. We had a great turnout of approximately 35 people. For those of you who could not attend or are interested in learning more about the book, please email us for a "Guide to Changing Habits" by the author as well as an outline of our discussion.

During the past few weeks, you may have noticed that we have not been writing as many posts as we typically do. Our focus over the past few weeks has been working on the redesigned website that we hope to launch within the next week. We appreciate everyone's understanding and we look forward to bringing you continued great content once this project is complete.

Tuesday, February 5, 2013

Bill Gross: Credit Supernova!

Manager Director of PIMCO, Bill Gross, penned this nicely written article Credit Supernova, which he attempts to explain the way credit has been working or accurately put has not been working within our monetary system.

As more and more QE is spread across the land, it returns less and less.

As more and more QE is spread across the land, it returns less and less.

- Each additional dollar of credit seems to create less and less heat. In the 1980s, it took four dollars of new credit to generate $1 of real GDP. Over the last decade, it has taken $10, and since 2006, $20 to produce the same result.

- So our credit-based financial markets and the economy it supports are levered, fragile and increasingly entropic – it is running out of energy and time. When does money run out of time? The countdown begins when investable assets pose too much risk for too little return; when lenders desert credit markets for other alternatives such as cash or real assets.

Saturday, February 2, 2013

2013 Week 5 Performance.....And Five Years Later We Are Back

In case you hadn't heard on Friday the Dow Jones Industrial Average finished above 14,000 and the S&P closed above the 1,500 mark. The significance behind these two numbers is that we have not been at these levels in over 5 years just prior to the bottoming out of the equity markets during the Great Recession.

A lot has happened over the last 5 years but no use walking down memory lane. What people really want to know is if this rally can continue to steam ahead? We wish we knew what the answer was although it makes us a little nervous when almost every night this week the lead story on ABC World News was about the stock markets.

As usual there is no shortage of uncertainties, but there are also pockets of "goodness" that continue to appear. The jobs number on Friday came in just about where people expected, initial jobless claims are still trending lower, and auto sales released on Friday have us on a record pace for 2013. I guess the best way to sum things up is that we are cautiously optimistic.

No one wants to be left behind in this current rally especially if you already missed most of the upswing over the past 5 years. According to a few reports that we have seen, those that stuck it through the great downturn are basically back to the same level prior to the crash or maybe even a little ahead.

But returning back to the question at heart, where do we go from here? The answer lies somewhere in the middle as usual. Those of you you have followed us over the course of the past few years already know that investing is not about being either all in or all out. We believe that it takes a balanced approach to succeed because you won't be able to avoid every bottom or catch every top.

At TAMMA, we have focused on both long-term and short-term strategies while basing our overall cash position within the portfolio on where we think the markets and economy are headed. This has resulted in sometimes excessively high cash positions which was most of the second half of 2012 while during the end of 2011 and beginning of 2012 we had a much lower cash position.

Currently our cash position is overly high for where we would like to be but part of that is due to market conditions. We will not chase performance. We want to ensure that we are buying positions at the price levels that will bring increased value and provide a level of safety.

Other news to note this week included the Case-Shiller Home Price Index which one again reiterated the climb in housing prices. The Consumer Confidence and Sentiment surveys were a bit mixed with one report up while the other was down. The big shocker of the week had to be the negative GDP number for Q4 2012. The decline was largely driven by a decrease in inventory build and a decline in government spending. We would say overall that most economic data released throughout the week showed a steady recovery which likely helped push the overall equity markets higher.

![[Chart]](http://wsj-us.econoday.com/showimage.asp?imageid=23930)

The Week Ahead

Compared to last week, this week is rather light on economic data. There doesn't appear to be any big drivers that could move market activity. So look for external news and continued company earnings reports to guide the markets.

A lot has happened over the last 5 years but no use walking down memory lane. What people really want to know is if this rally can continue to steam ahead? We wish we knew what the answer was although it makes us a little nervous when almost every night this week the lead story on ABC World News was about the stock markets.

As usual there is no shortage of uncertainties, but there are also pockets of "goodness" that continue to appear. The jobs number on Friday came in just about where people expected, initial jobless claims are still trending lower, and auto sales released on Friday have us on a record pace for 2013. I guess the best way to sum things up is that we are cautiously optimistic.

No one wants to be left behind in this current rally especially if you already missed most of the upswing over the past 5 years. According to a few reports that we have seen, those that stuck it through the great downturn are basically back to the same level prior to the crash or maybe even a little ahead.

But returning back to the question at heart, where do we go from here? The answer lies somewhere in the middle as usual. Those of you you have followed us over the course of the past few years already know that investing is not about being either all in or all out. We believe that it takes a balanced approach to succeed because you won't be able to avoid every bottom or catch every top.

At TAMMA, we have focused on both long-term and short-term strategies while basing our overall cash position within the portfolio on where we think the markets and economy are headed. This has resulted in sometimes excessively high cash positions which was most of the second half of 2012 while during the end of 2011 and beginning of 2012 we had a much lower cash position.

Currently our cash position is overly high for where we would like to be but part of that is due to market conditions. We will not chase performance. We want to ensure that we are buying positions at the price levels that will bring increased value and provide a level of safety.

Other news to note this week included the Case-Shiller Home Price Index which one again reiterated the climb in housing prices. The Consumer Confidence and Sentiment surveys were a bit mixed with one report up while the other was down. The big shocker of the week had to be the negative GDP number for Q4 2012. The decline was largely driven by a decrease in inventory build and a decline in government spending. We would say overall that most economic data released throughout the week showed a steady recovery which likely helped push the overall equity markets higher.

The Week Ahead

Compared to last week, this week is rather light on economic data. There doesn't appear to be any big drivers that could move market activity. So look for external news and continued company earnings reports to guide the markets.

- Mon - Factory Orders

- Tue - ISM Non-Mfg Index

- Wed - N/A

- Thu - Jobless Claims, Productivity and Costs, Consumer Credit

- Fri - International Trade, Wholesale Trade

Have a great week!

TAMMA Capital Management

I hope that readers have noticed the conversion to our new name and logo atop the website. You may have noticed that during the month of January we were not able to write as many posts as we usually do. Instead we have been spending a lot of time on the redesign project of the entire site. We hope to be able to launch the new site this week so stay tuned.

I also wanted to mention for those readers who live locally in Metro Detroit, we will be hosting a business book club review at The Community House in Birmingham this Wednesday February 6th from 6:30 to 8 PM. We will be discussing “The Power of Habit: Why We Do What We Do in Life and Business” by Charles Duhigg. Individuals and businesses are capable of tremendous shifts. It’s needed, because 40% of actions people perform each day aren't decisions, they’re habits. The way we organize our thoughts and work routines has tremendous impact on our productivity, financial security, health, and happiness. This book explores how habits emerge in individuals; examines the habits of successful companies; as well as the habits of society.

Friday, February 1, 2013

Morningstar Director of Technology

Since a growing portion of the TAMMA Fund and our individually managed client portfolios hold extensive technology positions, we thought that this Morningstar video report would give some additional insight into the tech sector.

Susan Cain Helped Introverts Find Their Voice; Now, She'll Teach Them To Embrace Public Speaking

For those of you looking for public speaking help either personally or for your business, take a look at this TED video of Susan Cain and the corresponding Fast Company article. Cain is a s self proclaimed introvert living in an extrovert world. Her message is to be true to yourself and listen to your own voice.

Why You Should Work From A Coffee Shop, Even When You Have An Office

Working out of a home office I personally can really relate to this Fast Company article highlighting some of the benefits of working outside of your home base. Some time just a change of scenary can do a world of good both from a creative and productivity standpoint.

- A change of environment stimulates creativity

- Fewer distractions

- Community and meeting new people

Subscribe to:

Posts (Atom)