It's hard to believe that we are about ready to close out yet another year. At least in my life, the years keep going by faster and faster as I have gotten older.

As with any year, this year has seen it's share of happiness, sorrows, and tragedies. With this year however, the personal and public tragedies have hit closer to home and more so around the holidays which have made them a little more harder to accept and deal with.

But with every new year, come the chance to begin anew. A fresh start if you will, filled with it's own sense of hope, optimism, and challenges.

2012 marked the first full year that we have operated our blog site here at DWCM. With this post we will have reached 733 for the year. Our goal has always been to be consistent and provide great content that people can use both in their personal and financial lives with 2 to 3 posts every day. Some days there were a little more and some days there were a little less.

I must say that none of this would be possible without the help and support of my family especially my wife and also my strategic business partner at The Jayne Group. These two people help form the backbone and foundation of our firm.

And with, I want to disclose for the first time to readers that DreamWorks Capital Management will be making a significant change at the beginning of the year. We have decided to change the name of our firm to TAMMA Capital.

After almost a year long process of determining the strategic vision for what I want this firm to be, it became clear that it is about the people which we help to support which includes families, clients, and readers. Our purpose is to help people achieve their lifestyle and financial goals by providing Personalized Investments for Your Future. To me, TAMMA Capital represents that purpose and what I want my firm to stand for.

We are completing the first phase of this project working with Identity Graphic Design and The Jayne Group in developing the name, logo, tag line, and new brand image. We hope to have this completed by the end of January. This will also mean a new website and email address. Phase two will involve a complete redesign of the current website. We will provide further details as we finalize phase one so that everyone knows where to find us and how to contact us.

It has been our pleasure in getting to know readers on a personal basis this year. We have appreciated all of your comments and viewership throughout the year and since we began this journey back in 2011.

We hope that all of you have a prosperous, safe, and happy 2013.

Paul Fenner, ChFC

President and CEO TAMMA Capital

Monday, December 31, 2012

Sunday, December 30, 2012

Cheer Up! The Cliff Doesn't Look So Grim

As we pointed out yesterday in our Week 52 performance post, there are going to be some real people that are affected n a negative way if there are no resolutions in some key areas such as the extension of unemployment benefits and taxes namely the AMT patch.

As we often like to do, we want to see the contrarian view of this argument regarding how bad the cliff could be. As with anything in life it's business as usual until something happens to you and then it becomes personal.

Gene Epstein, in his weekly Barron's column provides his insights given the fiscal cliff situation.

As we often like to do, we want to see the contrarian view of this argument regarding how bad the cliff could be. As with anything in life it's business as usual until something happens to you and then it becomes personal.

Gene Epstein, in his weekly Barron's column provides his insights given the fiscal cliff situation.

- Technically, the cliff consists of a fiscal tightening, the opposite of a fiscal stimulus -- if stimulus from one year to the next is supposed to boost economic growth, then a fiscal tightening should slow it down. Over the long run, deficit reduction should be the goal. But it can be disruptive if the fiscal tightening is too great in a single year.

- Looking back at the years since World War II, nothing remotely compares with the fiscal tightening that occurred in 1946 and '47. Despite warnings at the time from Keynesian economists about an imminent depression, the deficit as a share of nominal GDP fell to 7.2% of nominal GDP in '46 from 21.5% the year before, a tightening of 14.3 percentage points. And to add insult to economic injury, that 7.2% deficit turned into a surplus of 1.7% by '47, after a further tightening of 8.9 percentage points.

- ...the incessant warnings about the fiscal cliff may be one reason personal saving has recently increased, perhaps in preparation for the tax hikes. And despite the collapse in asset values during the great recession, household net worth as a share of income is actually much higher than it was in years prior to 1970, leaving households better prepared.

Barron's Weekend Edition

Barron's had several really great article in their weekend edition. Their cover story talked about the end of cash as we move towards a plastic society vs. cash. There are two big winners in this story which are Visa V and MasterCard MA (Full disclosure I own personal shares of Visa). Both V and MA only process transactions rather than lending money and being exposed to credit default risks. V and MA virtually trade in tandem with each other and we would be buyers of either or both given any significant pull back.

- Cash's disappearance has been slow but inexorable. Upscale merchants are doing away with cash registers in favor of hand-held devices, like the ones that are ubiquitous in Apple stores. Web-based retailers don't take cash at all. And on the highways, even toll booths are fading. Waiting in the wings is a generation of kids that have grown up with debit cards, prepaid cards, and iTunes accounts. The ATM is now as foreign to teenagers as bank tellers were to their parents.

- Thirty years from now, if recent trends continue, cash could fall to just 10% of U.S. retail purchases.

In an interview with Ian Bremmer, founder of New York-based Eurasia Group, a political-risk consultancy, he describes a world in which the US is no longer the leader nor does it want to be due to growing domestic issues as home. It has been widely discussed here in the US as to why america has to or needs to be the policeman to the world?

- It is a world that is more difficult to navigate. The U.S. is no longer interested in or willing to provide the kind of leadership it has historically. It doesn't want to be the world's policeman or the lender of last resort or the driver of globalization. No one else is willing to do it, either. G-Zero replaces the U.S.-led flat world. It means a lot more volatility in the markets, since you'll have a lot of different standards, types of trade flows, gravitational centers.

- Companies need to hedge, to be able to pivot, so they don't end up underperforming. You see Japan's difficulties because of the conflict with China. In a flat world, in the absence of G-Zero, a Japanese exporter like Nissan goes where the economics are good and doesn't pay a lot of attention to governments. In a G-Zero world, politics matter more. Suddenly, the China-Japan conflict is enormously important, and exports to China fall off a cliff. Nissan used to sell 25% of its cars to China. Now half of that is gone. Likewise, Facebook

(ticker: FB) thought it was in a flat world; it isn't. Facebook's goal is to sell to the seven billion people in the world, [with] a big connect to the first billion. But the world's largest Internet market, China, has no interest in Facebook. They want their own. That's not a flat world.

Saturday, December 29, 2012

The Efficacy of the FOMC’s Zero Interest Rate Policy

When most people think of the Federal Reserve they think of Ben Bernanke, Alan Greenspan, or Paul Volker and the the decisions that these men have made to help define US monetary policy for the past several decades. However, that would only be part of the Fed picture.

The Fed is actually made up of several reserve banks spread geographically around the country. Each bank has its own staff which complete research reports based on data that they compile.

One of the best if not the best Fed bank when it comes to presenting useful data is the Federal Reserve Bank of St. Louis led by James Bullard. There is a link on their site which allows you to sign up for free data and reports such as this article The Efficacy of the FOMC’s Zero Interest Rate Policy by Daniel Thornton.

In the article Thornton discusses the impact that low interest rates can have on the economy when they are left at abnormally low levels for a long period of time.

The Fed is actually made up of several reserve banks spread geographically around the country. Each bank has its own staff which complete research reports based on data that they compile.

One of the best if not the best Fed bank when it comes to presenting useful data is the Federal Reserve Bank of St. Louis led by James Bullard. There is a link on their site which allows you to sign up for free data and reports such as this article The Efficacy of the FOMC’s Zero Interest Rate Policy by Daniel Thornton.

In the article Thornton discusses the impact that low interest rates can have on the economy when they are left at abnormally low levels for a long period of time.

- ...in addition to the direct effect on current income, persistently low real interest rates might motivate individuals to save more in an attempt to compensate for lower expected future returns and higher risk. This effect is likely to intensify the longer real rates are abnormally low.

- The problem here is that the interest rate channel of mon¬etary policy has been thought to be relatively weak for a variety of reasons: (i) Policy actions have the largest effect on short-term rates, but longer-term rates, which are much less affected, matter for most spending decisions; (ii) rates on credit cards, revolving lines of credit, and other condi¬tions that would affect consumer spending are relatively insensitive to changes in the policy rate; (iii) businesses say that interest expense is a relatively minor consideration when making investment decisions—the most important consideration is the expected stream of income from the investment; and (iv) much corporate investment is com¬pletely or partially internally financed.

- In any event, if investment spending is sufficiently insensitive to changes in the interest rate and the effect of the Fed’s actions on interest rates is sufficiently weak, the net effect of the FOMC’s persistent zero interest rate policy could hinder economic growth.

Week 52 Performance.....A Wild Ride

It's hard to believe that we have made it through our first complete calendar year of weekly performance posts here at DWCM. As usual within the markets, there were plenty of ups and downs.

And speaking of downs, that has been the clear direction of the equity markets since fiscal cliff talks broke apart a little over a week ago. All four major equity indices were down almost 2% for the week and have been down for the last 5 trading days in a row.

We are of the opinion that even if we do get some type of late minute deal, the markets will likely take some time to digest but then continue their lower ways. Any deal at this point is going to be a patch. How big of a patch is the question?

The real keys to this fiscal cliff issue in our view, are the extension of unemployment benefits for nearly 2 million people and the increases in taxes. Lets start with the biggest issue taxes.

We never saw cutting the payroll taxes as a really good idea to begin with. The intention of this cut was to spur demand among already cash strapped consumers still recovering from the great recession. Data has shown that most people have been reducing debt and cleaning up their own personal balance sheets rather than going out to spend. Washington should take note of this ingenious idea, spend less than you make!

The other major piece with the tax cuts are figuring out what rates people are going to pay and how they will be affected by the Alternative Minimum Tax (AMT) that will hit millions of tax payers this year for the first time if no patch is passed through congress. In either case the IRS has already stated that this is going to cause massive delays in the filling of people's taxes. This means that people expecting their tax returns within the first quarter of the year are going to have to wait. This wait is going to further erode confidence and more importantly cause people to cut back spending. Just the opposite of what the plan was supposed to do. Thank you politicians.

Further declines in spending will also occur when 2 million household loose their unemployment benefits. This is a trickier issue to deal with. Although we are not fans of all the unemployment extensions, we do know how hard it will adversely affect people's lives. I'm sure that there is a certain percentage of people who simply cannot find work while there are others who are likely milking the system.

So bottom line, Q1 growth is going to be bad in our opinion. We just don't know how bad it will get and what the lingering effects could be. This is why we are not looking for any type of rally within the equity markets during the beginning of the year and we expect the losses to continue. Of course you could get snap back rallies here and there, but the overall direction of the markets we see as being down.

On that positive note, let us turn our attention to the YTD performances of the DWCM fund and the markets. While we still have one last trading day left in 2012 on Monday, it is likely that the NASDAQ, S&P 500 and Russell 2000 will all close with double digit returns while the DJIA will return something in the mid single digits.

The DWCM Fund is on pace to finish above the 20% level beating all four major equity benchmarks quite handily. As much despair as there has been in the markets for most of the second half of the year, we are very proud of our performance given the gloom and doom atmosphere.

We have had very consistent performers across the board throughout the year. Even though Apple is down now, we harvested big gains early in the mid year with this name. The same also applies to Google which we no longer have a position in but reaped big profits on our option position during Q1 and Q2.

Our agriculture strategy also did very well this year with names such as Mosaic, Monsanto, and irrigation supplier Lindsay. Some individual names that had stellar years were Ford, help by increased North American sales and coffee chain Caribou which was taken private a few weeks ago.

One of our our biggest misses this year where our options moves especially in our current Apple long call position. However, this has over a year to play out and if things could just stabilize in Washington a bit we believe that solid names like Apple will rebound and continue to perform.

The net short position in the group of home builder stocks has been a disappointment in 2012. Housing has actually been a strength in the recovering economy even though we still believe that the home builders are priced for perfection. We will likely be leaving this position on at least through the first few months of the year to see how things materialize with the fiscal cliff fallout.

The Week Ahead

Monday is the last trading day of the year but the real action (good or bad depending upon your view) is taking place this weekend at the White House. At this point it's any ones guess as to what outcome may come about with the fiscal talks. As we have stated previously, we believe that much damage has already been done leading up to this point.

Volume is going to be extremely light on Monday which could provide additional fuel for a upside or downside rally depending upon any updates out of Washington. We are staying away at this point and will just watch the drama unfold. It is best to be protecting capital in these types of situations.

The first week of the new year will pack quite an economic punch. In addition to the fiscal cliff debacle, this is also a jobs report week. You will also be seeing same store sales from retail chains which will give further clarification as to whether or not it was a successful holiday season. Recall that the first report out here showed that growth was extremely week.

And speaking of downs, that has been the clear direction of the equity markets since fiscal cliff talks broke apart a little over a week ago. All four major equity indices were down almost 2% for the week and have been down for the last 5 trading days in a row.

We are of the opinion that even if we do get some type of late minute deal, the markets will likely take some time to digest but then continue their lower ways. Any deal at this point is going to be a patch. How big of a patch is the question?

The real keys to this fiscal cliff issue in our view, are the extension of unemployment benefits for nearly 2 million people and the increases in taxes. Lets start with the biggest issue taxes.

We never saw cutting the payroll taxes as a really good idea to begin with. The intention of this cut was to spur demand among already cash strapped consumers still recovering from the great recession. Data has shown that most people have been reducing debt and cleaning up their own personal balance sheets rather than going out to spend. Washington should take note of this ingenious idea, spend less than you make!

The other major piece with the tax cuts are figuring out what rates people are going to pay and how they will be affected by the Alternative Minimum Tax (AMT) that will hit millions of tax payers this year for the first time if no patch is passed through congress. In either case the IRS has already stated that this is going to cause massive delays in the filling of people's taxes. This means that people expecting their tax returns within the first quarter of the year are going to have to wait. This wait is going to further erode confidence and more importantly cause people to cut back spending. Just the opposite of what the plan was supposed to do. Thank you politicians.

Further declines in spending will also occur when 2 million household loose their unemployment benefits. This is a trickier issue to deal with. Although we are not fans of all the unemployment extensions, we do know how hard it will adversely affect people's lives. I'm sure that there is a certain percentage of people who simply cannot find work while there are others who are likely milking the system.

So bottom line, Q1 growth is going to be bad in our opinion. We just don't know how bad it will get and what the lingering effects could be. This is why we are not looking for any type of rally within the equity markets during the beginning of the year and we expect the losses to continue. Of course you could get snap back rallies here and there, but the overall direction of the markets we see as being down.

On that positive note, let us turn our attention to the YTD performances of the DWCM fund and the markets. While we still have one last trading day left in 2012 on Monday, it is likely that the NASDAQ, S&P 500 and Russell 2000 will all close with double digit returns while the DJIA will return something in the mid single digits.

The DWCM Fund is on pace to finish above the 20% level beating all four major equity benchmarks quite handily. As much despair as there has been in the markets for most of the second half of the year, we are very proud of our performance given the gloom and doom atmosphere.

We have had very consistent performers across the board throughout the year. Even though Apple is down now, we harvested big gains early in the mid year with this name. The same also applies to Google which we no longer have a position in but reaped big profits on our option position during Q1 and Q2.

Our agriculture strategy also did very well this year with names such as Mosaic, Monsanto, and irrigation supplier Lindsay. Some individual names that had stellar years were Ford, help by increased North American sales and coffee chain Caribou which was taken private a few weeks ago.

One of our our biggest misses this year where our options moves especially in our current Apple long call position. However, this has over a year to play out and if things could just stabilize in Washington a bit we believe that solid names like Apple will rebound and continue to perform.

The net short position in the group of home builder stocks has been a disappointment in 2012. Housing has actually been a strength in the recovering economy even though we still believe that the home builders are priced for perfection. We will likely be leaving this position on at least through the first few months of the year to see how things materialize with the fiscal cliff fallout.

The Week Ahead

Monday is the last trading day of the year but the real action (good or bad depending upon your view) is taking place this weekend at the White House. At this point it's any ones guess as to what outcome may come about with the fiscal talks. As we have stated previously, we believe that much damage has already been done leading up to this point.

Volume is going to be extremely light on Monday which could provide additional fuel for a upside or downside rally depending upon any updates out of Washington. We are staying away at this point and will just watch the drama unfold. It is best to be protecting capital in these types of situations.

The first week of the new year will pack quite an economic punch. In addition to the fiscal cliff debacle, this is also a jobs report week. You will also be seeing same store sales from retail chains which will give further clarification as to whether or not it was a successful holiday season. Recall that the first report out here showed that growth was extremely week.

- Mon - Dallas Fed Mfg Survey

- Tue - Happy New Year

- Wed - PMI Manufacturing Index, ISM Mfg Index, Construction Spending

- Thu - Chain Store Sales, Challenger Job-Cut Report, ADP Employment Report, Jobless Claims

- Fri - Employment Situation, Factory Orders, ISM Non-Mfg Index

Have a safe, prosperous, and happy New Year!

DreamWorks Capital Management

If you are currently trying to develop your own investment plan or are seeking the help of a professional investment advisor we urge you to give us the opportunity to show you what DWCM can do for you. No matter what stage in life you are currently at, DWCM can help you plan for your ever changing needs.

DWCM can you help you with any of the steps in your wealth management journey including;

- Addressing emergency fund needs

- Developing a retirement plan

- Sending a child to college

- Looking at various investment options

- Determining how to involve philanthropic passions as apart of your planning process

With our "SMART Principles", we can help you develop your unique goals and create a focused customized plan to achieve your financial and lifestyle goals.

Friday, December 28, 2012

How to think about risk in financial planning

One of the first things that we talk with prospectus clients about is their risk/reward profile. How much risk is someone willing to take on for a given level of return or reward?

This question can begin quite the debate especially among couples because often their risk/reward profiles can be very different from each other. One partner could be very risk adverse while the other is more aggressive. One of our big jobs is to bridge those gaps in a way that helps the client achieve their financial and lifestyle goals.

However, most people likely think about risk in terms of market gains and losses. As Larry Swedroe at CBS MoneyWatch points out in this article as he was interviewed by Bloomberg's Pimm Fox, there are quite a few more risks lurking out there that people need to be paying attention to. These risk including the following:

This question can begin quite the debate especially among couples because often their risk/reward profiles can be very different from each other. One partner could be very risk adverse while the other is more aggressive. One of our big jobs is to bridge those gaps in a way that helps the client achieve their financial and lifestyle goals.

However, most people likely think about risk in terms of market gains and losses. As Larry Swedroe at CBS MoneyWatch points out in this article as he was interviewed by Bloomberg's Pimm Fox, there are quite a few more risks lurking out there that people need to be paying attention to. These risk including the following:

- Longevity risk - you outlive your assets

- Liquidity risk - you need access to cash quickly but cannot access

- Inflation risk - loss of purchasing power

- Life Event risk - death, divorce, new children, etc. you name the event and there is a risk you may not be prepared for it

USA TODAY analysis: Nation's water costs rushing higher

Most people likely worry more about what price they are paying at the pump for gasoline or how much it costs them to heat their home. However, as this USA Today report points out, you should be just as concerned about your water bill.

Being surrounded by the great lakes where I live in MI, one could easily take for granted one of the most abundant sources of fresh water available on earth. You would think that with all this water people in the Great Lakes region would be paying less for what which isn't the case.

The USA Today piece as an interactive map showing the areas hit hardest around the country by rising water rates. The Great Lakes region is not immune to these increases. It would be interesting to know what other parts of the country are paying for water especially in the southwest where water would be in less supply.

The cost of upgrading the country's water system will help keep rates elevated for some time. In some cases water is more precious a natural resource than is oil or gas. Getting access to new sources of water will likely be more costly in the past just like oil as the easy finds have already been had.

Being surrounded by the great lakes where I live in MI, one could easily take for granted one of the most abundant sources of fresh water available on earth. You would think that with all this water people in the Great Lakes region would be paying less for what which isn't the case.

The USA Today piece as an interactive map showing the areas hit hardest around the country by rising water rates. The Great Lakes region is not immune to these increases. It would be interesting to know what other parts of the country are paying for water especially in the southwest where water would be in less supply.

The cost of upgrading the country's water system will help keep rates elevated for some time. In some cases water is more precious a natural resource than is oil or gas. Getting access to new sources of water will likely be more costly in the past just like oil as the easy finds have already been had.

- USA TODAY's study of residential water rates over the past 12 years for large and small water agencies nationwide found that monthly costs doubled for more in 29 localities. The unique look at costs for a diverse mix of water suppliers representing every state and Washington, D.C. found that a resource long taken for granted will continue to become more costly for millions of Americans. Indeed, rates haven't crested yet because huge costs to upgrade or repair pipes, reservoirs and treatment plants loom nationwide.

- The trend toward higher bills is being driven by:

- The cost of paying off the debt on bonds municipalities issue to fund expensive repairs or upgrades on aging water systems.

- Increases in the cost of electricity, chemicals and fuel used to supply and treat water.

- Compliance with federal government clean-water mandates.

- Rising pension and health care costs for water agency workers.

- Increased security safeguards for water systems since the 9/11 terror attacks.

Thursday, December 27, 2012

Should the 401(k) Be Reformed or Replaced?

Social Security, Medicare, and Medicaid usually garner most of the attention and debate when it comes to retirement in the US. The plan that comes in and out of the lime is the current 401k system.

As most Americans have come to realize either by force or circumstance, is that American companies are not providing for the once generous retirements plans that they once offered. Guaranteed retirement plans such as pension and medical coverage are going by the waste side. More and more Americans have to count upon themselves in order to both plan and save for retirement.

However, does the current 401k system have the wherewithal to support this growing demand. Many people say no which is the focus of this NYT piece.

As most Americans have come to realize either by force or circumstance, is that American companies are not providing for the once generous retirements plans that they once offered. Guaranteed retirement plans such as pension and medical coverage are going by the waste side. More and more Americans have to count upon themselves in order to both plan and save for retirement.

However, does the current 401k system have the wherewithal to support this growing demand. Many people say no which is the focus of this NYT piece.

- But many investment experts and economists give the 401(k) system low marks. They note that fewer than half of the nation’s private sector workers are in 401(k) plans and that nearly a quarter of businesses with more than 100 employees do not offer 401(k)’s. Moreover, many Americans put only 3 percent of their earnings into 401(k)’s when investment experts often recommend saving 10 or even 12 percent.

- The typical worker age 55 to 64 had just $54,000 in a 401(k) in 2010, according to a new report by the Center for Retirement Research at Boston College, and households with workers in that age group had $120,000 in retirement savings on average, if the money rolled into I.R.A.’s was included. That $120,000 is less than one-fourth the savings recommended by many retirement experts. Moreover, the center calculated, that $120,000 would provide an annuity of a paltry $7,000 a year.

|

| Andy Manis for The New York Times |

- Stephen P. Utkus, director of the Vanguard Center for Retirement Research, said most Americans saved far too little. “Certainly by your 30s, you should be saving 10 percent,” he said

- He said many Americans emptied their 401(k)’s after they were laid off, leaving them with far too little savings for retirement. “You can’t invest your way out of a savings problem,” Mr. Utkus warned. “To catch up, you have to save more or maybe work longer. My general advice for people is, save 3 percent more of your income each year and plan to work three more years.”

Wednesday, December 26, 2012

Preparing financially for a family

Having just had a newborn myself within the past few months and continually talking with new parents the financial burden that a new bundle of joy can be overwhelming even for those that may have planned for it. When people ask my wife and I how we deal with our newly created family we always tell people it takes a village which is why we live so close to family and friends.

Ironically this USA Today article features a financial planner in Metro Detroit that is ready to become a new parent for the first time. The article offers sound financial advice no matter if you are having children or not.

I will stress this one point of advice for soon to be parents especially those of you that may be expecting multiples such as I had a few years ago. It is absolutely crucial that you have some sort of emergency fund. This is an absolute must have in any wealth management plan but especially important when you consider adding members to your family who you will now be responsible for.

Take it from me personally, and I am one that plans quite extensively, there are things that you are going to miss when putting a plan or budget together. Having that emergency fund is critical because it is highly unlikely that you will be able to add to it early on when you are adjusting to new expenses that you have never had before.

Ironically this USA Today article features a financial planner in Metro Detroit that is ready to become a new parent for the first time. The article offers sound financial advice no matter if you are having children or not.

I will stress this one point of advice for soon to be parents especially those of you that may be expecting multiples such as I had a few years ago. It is absolutely crucial that you have some sort of emergency fund. This is an absolute must have in any wealth management plan but especially important when you consider adding members to your family who you will now be responsible for.

Take it from me personally, and I am one that plans quite extensively, there are things that you are going to miss when putting a plan or budget together. Having that emergency fund is critical because it is highly unlikely that you will be able to add to it early on when you are adjusting to new expenses that you have never had before.

Dateline: Drought, USA

Although this USA today article is from September I didn't get a chance to post it. However I want to keep this drought story in front of readers because it is simply not going away just because the weather has turned cold. (See additional posts on this topic here, here, and here)

On the contrary, many parts of the US count on heavy snowfalls in order to replace the water supply that lies far beneath the ground. Thus far this year, the snow has largely stayed away and we are on track for another lite year.

The impact of this USA drought goes well beyond the headlines. It will have an impact upon almost every American. The farmer with less income that can't buy new equipment, the small business entrepreneur that own a lawn and garden business in the summer and plows snow in the winter is having to tighten his belt once again which means less demand for certain products. This then causes a chain reaction that affects other people and consumers. I hope that you see where I am going with this.

That is the focus of this USA Today peiece, the impact it has had on the individuals.

On the contrary, many parts of the US count on heavy snowfalls in order to replace the water supply that lies far beneath the ground. Thus far this year, the snow has largely stayed away and we are on track for another lite year.

The impact of this USA drought goes well beyond the headlines. It will have an impact upon almost every American. The farmer with less income that can't buy new equipment, the small business entrepreneur that own a lawn and garden business in the summer and plows snow in the winter is having to tighten his belt once again which means less demand for certain products. This then causes a chain reaction that affects other people and consumers. I hope that you see where I am going with this.

That is the focus of this USA Today peiece, the impact it has had on the individuals.

- Homeowners far from farmland are paying for expensive repairs to basements and foundations separated from the shrinking soil around them. Businesses that depend on water -- a canoe rental company, a campground that counts on its well-stocked fishing pond to attract visitors -- feel the economic pain, too.

- Americans in the stricken states and well beyond them are feeling the pain, as the prices of food, gas, retail goods and utilities have all ticked up.

- The extreme drought has been exacerbated by near-record heat: The summer of 2012 was the third-hottest in U.S. weather history, and July was the hottest month the nation has ever recorded.

Apple vs. Google vs. Facebook vs. Amazon

The big four in terms of technology giants Apple, Google, Facebook, and Amazon seem to be on a collision course with each other. At one point in time their wares were virtually separate but now they clearly infringe upon each other turfs.

When I see these four names, I can't help but to think of companies that may have been apart of this illustrious group of tech titan in years past. Names such as Microsoft, Yahoo, AOL, and even IBM. Did I miss any? The landscape of technology is ever changing. Makes you wonder what the big four will look in 5 or even 10 years from today?

This WSJ article takes a look at the lines being drawn at the aforementioned companies specifically in the areas of search and hardware where the lines become very blurred between them.

When I see these four names, I can't help but to think of companies that may have been apart of this illustrious group of tech titan in years past. Names such as Microsoft, Yahoo, AOL, and even IBM. Did I miss any? The landscape of technology is ever changing. Makes you wonder what the big four will look in 5 or even 10 years from today?

This WSJ article takes a look at the lines being drawn at the aforementioned companies specifically in the areas of search and hardware where the lines become very blurred between them.

- Software giants including Google and Amazon are interested in ramping up hardware to boost customer loyalty and to extend control over their software services and the revenues that flow from them. That is heightening their collision course with Apple, which is responding by building more of its own software to make its devices stand out.

- Google, with the $12.5 billion purchase of Motorola Mobility under its belt, plans to use the phone maker to release new Android devices to help knock Apple's iPhone off its perch. And Amazon, which has upped the ante in the tablet wars with the Kindle Fire, has also been testing its own phone.

- Meanwhile, all four companies see search as a big opportunity for retaining and profiting off customers. While Google's paradigm of typing queries in a search box has prevailed for years, now its rivals want to undercut the Web-search giant through mobile search on smartphones and other devices, and a slew of search services that allow recommendations from friends.

Tuesday, December 25, 2012

US Holiday Retail Sales Growth Weakest Since 2008

This is the first of many articles and data points that you will begin to see in the media outlets regarding the 2012 holiday shopping season. According to this CNBC article courtesy of SendingPluse 2012 reatils sales saw it lowest increase since the 2008 recession year.

There were so many factors to consider this year when it came to spending so let's check off a few of the major ones.

There were so many factors to consider this year when it came to spending so let's check off a few of the major ones.

- Super storm Sandy

- A once again unseasonably warm winter

- Fiscal Cliff

- Tragedy at Sandy Hook in Newtown, CT

I'm sure that you could add to the list but the point here is that there were plenty of reason to stay away form the stores and for consumers to cut back on their spending.

Full CNBC piece here

- A report that tracks spending on popular holiday goods, the MasterCard Advisors SpendingPulse, said Tuesday that sales in the two months before Christmas increased 0.7 percent, compared with last year. Many analysts had expected holiday sales to grow 3 to 4 percent.

- In 2008, sales declined by between 2 percent and 4 percent as the financial crisis that crested that fall dragged the economy into recession. Last year, by contrast, retail sales in November and December rose between 4 percent and 5 percent, according to ShopperTrak, a separate market research firm. A 4 percent increase is considered a healthy season.

- The SpendingPulse data include sales by retailers in key holiday spending categories such as electronics, clothing, jewelry, luxury goods, furniture and other home goods between Oct. 28 and Dec. 24. They include sales across all payment methods, including cards, cash and checks.

|

| Getty Images |

Merry Christmas

As the last of the clean up has been completed and all of the little ones finally in bed, I wanted to wish everyone a very Merry Christmas. It has been a year full of blessings and sorrows as well.

I couldn't help but take a few minutes to think about all of the things that I am thankful for. But also a few moments to think about those affected by several tragedies this year especially in Newtown, CT.

I couldn't help but take a few minutes to think about all of the things that I am thankful for. But also a few moments to think about those affected by several tragedies this year especially in Newtown, CT.

Monday, December 24, 2012

Labor lite

Labor productivity has been a hot topic that we have focused on here at DWCM since we started this site well over a year ago. In one of the local business papers that I receive each week Crain's Detroit, they featured a small enterprise here in metro Detroit that is making it's mark in part due to increased machine efficiency resulting in the need for less people.

When most people think of mass productivity improvements they likely think of big Fortune 500 and multinational companies who are force behind this C-change. But more and more smaller companies are getting in on the act as well. Most are driven by a need to compete with cheap overseas labor but to also boost it's own bottom lines. As the cost of labor rises around the globe especially in China, it has helped spurned a manufacturing renascence in US manufacturing with companies finding new ways to complete.

See full story here by Dustin Walsh of Crain's Detroit

When most people think of mass productivity improvements they likely think of big Fortune 500 and multinational companies who are force behind this C-change. But more and more smaller companies are getting in on the act as well. Most are driven by a need to compete with cheap overseas labor but to also boost it's own bottom lines. As the cost of labor rises around the globe especially in China, it has helped spurned a manufacturing renascence in US manufacturing with companies finding new ways to complete.

See full story here by Dustin Walsh of Crain's Detroit

- At Prism Plastics LLC in Chesterfield Township, a mere three employees per shift work the 26,000-square-foot factory, programming machines and packing boxes. The plastic injection molding supplier produces 500 million parts across its four plants and 28 molding machines. The machines need no sleep, coffee breaks or vacations. They work three shifts, 24 hours a day, seven days a week. And with just 58 total employees, Prism is the model of modern manufacturing -- fewer humans, more machines, higher efficiency, increased productivity.

- Over the past year, manufacturing productivity increased 2.9 percent as output increased 5.5 percent, the U.S. Bureau of Labor Statistics reported this month.

- In the world of economics and labor statistics, higher productivity translates into a reduction in hiring. Nationally, the automotive industry employs 780,700, down from more than 1.2 million in 2002. Michigan's auto employment is down to nearly 96,200 from more than 190,000 a decade ago.

- The reduced workforce has paid off for Prism, which also has plants in Port Huron and Harlingen, Texas. Revenue has grown from $5 million in 2009 to $12 million in 2011, with projections of $18 million this year and $22 million in 2013.

- For the Southeast Michigan workforce, supply chain efficiency means average hourly earnings in the automotive supply base are down to the lowest point in years. The average hourly earnings in the supply base were $19.68 in July, down from $19.80 in 2002 and $21.32 in 2006.

- To expand its Chesterfield plant, Prism took out a $2.5 million line of credit, purchasing six Toshiba molding machines, valued at about $500,000 each.

- "These jobs are good jobs, and they don't need a four-year degree," he said. "But these jobs require more skill, and I see us (the auto industry) moving to a more skilled workforce."

Apple Moves Closer to Making TV Set

Apple has been a free fall sense hitting it's all time high of slightly over $700 per share back in September. There are reports now that are surfacing which have iPhone 5 sales down substantially putting even added stress upon the stock.

We are still long-term believers in the the stock and company for a few reasons.

We are still long-term believers in the the stock and company for a few reasons.

- Apple executes almost flawlessly. Have they had their hiccups lately with the Maps app...yes, will they have other issues crop up in the future...certainly. But overall Apple gets things right at a much higher percentage than most.

- With a cult like following, Apple can continue to expand it's market share as more and more people are introduced to its products and become hooked.

- It finds a way to revolutionize industries such as music, apps, and tablets.

But what will the next revolution be? The next catalyst that helps send the stock back in an upward transition? Many believe that it will be the TV market. It may not be a slam dunk as expert may give Apple credit for with content providers seeing clearly what happened in the music industry. But one cannot deny that sooner or later someone is going to get TV right in a way in which consumers will flock in droves to a specific product.

We believe that Apple, even with its flaws certainly stands to be a game changer in this industry. This WSJ article lays out what it is hearing from apple suppliers who are working on a new TV project.

Ambition: The Great Disruptor

What is one of the biggest driving forces behind change in this world...ambition. Ambition is the desire to make things better. Whether it is our jobs, families, businesses, or in some cases the pursuit of freedoms that people have never had, ambition is the "secret sauce" that helps drive change. However as we all know, ambition can be used for both good and for evil.

This article in the Atlantic by Sally Osberg, President and CEO of the Skoll Foundation, provide some of her insights behind this mega force.

This article in the Atlantic by Sally Osberg, President and CEO of the Skoll Foundation, provide some of her insights behind this mega force.

- Ambition translates aspiration into action. It's the secret sauce that accelerates problem solving, spurs entrepreneurship, and galvanizes leadership. Most important, ambition is what drives human beings to improve their lives.

- Ambition can seem invisible, but its energy is undeniable. Throughout the world, the ambition of women and men seeking freedom, self-determination, and opportunity is gathering force. Social entrepreneurs grasp what's going on. They see and are seizing the moment, knowing that in the decade to come, this upwelling of ambition can change countries, transform societies, and remake the world.

Saturday, December 22, 2012

The Disciplined Pursuit of Less

As another holiday season winds down, this HBR article titled The Disciplined Pursuit of Less definitely caught my eye. But also to my surprise is that this article is actually about life choices and more specifically career choices.

In the piece by Greg McKeown, CEO of THIS Inc, McKeown argues that "success is a catalyst for failure." McKeown goes on to point out why successful people and organizations don't automatically become very successful in which he identifies in four predictable phases:

In the piece by Greg McKeown, CEO of THIS Inc, McKeown argues that "success is a catalyst for failure." McKeown goes on to point out why successful people and organizations don't automatically become very successful in which he identifies in four predictable phases:

- Phase 1: When we really have clarity of purpose, it leads to success.

- Phase 2: When we have success, it leads to more options and opportunities.

- Phase 3: When we have increased options and opportunities, it leads to diffused efforts.

- Phase 4: Diffused efforts undermine the very clarity that led to our success in the first place.

He then goes on to identify three suggestions as to how to avoid the clarity paradox and continue our upward momentum:

- Use more extreme criteria.

- Ask "What is essential?" and eliminate the rest

- Beware of the endowment effect

See all of the details in his piece here

Week 51 Performance.....A Nation Continues to Mourn on Multiple Fronts

The nation observed a moment of silence yesterday morning around 9:30 AM EST in memory of the 26 people who tragically lost their lives at Sandy Hook elementary school in Newtown, CT. As we learned more about this horrific event throughout the week we tried to stay focused on the hero's who emerged and saved lives vs. the troubled youth behind the gun. So many brave little youngsters and teachers. It is still such an emotional topic to try and discuss.

On the other side of the Sandy Hook tragedy, you have have the tragedy that is our current political system and leaders. I can't tell you how many people that I speak with that are more concerned about the anti-bipartisanship going on in Washington than they are worried about going off of the fiscal cliff.

When people that never talk finance or politics started talking more and more about the fiscal cliff over the past few weeks this gave us cause for great concern. There is no doubt that if nothing is done to remedy the automatic spending cuts and increased taxes there will be an impact upon the economy. However, we would argue that the biggest impact is already being felt which is a crisis of confidence. The sense that we have no idea what direction we may be going in makes people scared and causes paralysis in which no one moves at all.

Several times this week while listening to Bloomberg radio, I heard of multiple Fortune 500 companies having developed multiple operating plans for 2013 based upon what outcome may arise out of Washington. Just think of the time and effort wasted on non-productive activities all because politicians can't come together and do what is in the best interest of the country and its people.

While perplexing as all of this may be, the equity markets have stared this adversity down for the better part of the year and especially over the past two weeks. Friday was a bit of a wake up call as the markets began to pull back sharply on news that a deal as it stands today is not likely to happen. The so called "Plan B" of the Republican party blew up in their faces leaving the Democrats holding all of the cards and not needing to make any moves themselves so that they can blame the other party and vice verse.

We at DWCM are still amazed that the markets have down as well as they have in the face of all of this uncertainty. Of the four equity benchmarks that we compare ourselves against, all but the DJIA will likely finished the year with double digit returns. Even the DJIA will likely produce a high single digit return. Currently the DWCM Fund stands a return above 20% besting all four indices.

The next week could be one of the most volatile trading week of the year for a few reasons. One, most traders and institutional players are off this week which creates extremely low trading volumes which could swing prices in either direction. Second, and likely the biggest driver will be if any deal is reached in Washington. If no deal is reach expect a decent sell off that could linger into the new year. Even if a patch work deal is put together, people may not be fooled and a sell off could still ensue.

We plan to take a cautious approach this week and and pay close attention to our current long-term positions that we would be adding additional capital to in the event of a sell off. In addition, we will be monitoring our current watchlist (which we will update on our website today) for those positions that we would like to bring on as part of our long-term strategy as well.

We believe that currently it is just too hard to determine in the short-term what direction the markets may be headed in which is why we will be focusing in on the long-term side of our portfolio.

The Week Ahead

As we noted previously, we expect that this could be a very volatile week within the equity markets. In addition to shortened trading hours on Monday and closed for Christmas on Tuesday, the rest of the week will be full of political conversations and "what if" scenarios. However, don't loose site of some very important economic data to be released most centered around the housing market.

On the other side of the Sandy Hook tragedy, you have have the tragedy that is our current political system and leaders. I can't tell you how many people that I speak with that are more concerned about the anti-bipartisanship going on in Washington than they are worried about going off of the fiscal cliff.

When people that never talk finance or politics started talking more and more about the fiscal cliff over the past few weeks this gave us cause for great concern. There is no doubt that if nothing is done to remedy the automatic spending cuts and increased taxes there will be an impact upon the economy. However, we would argue that the biggest impact is already being felt which is a crisis of confidence. The sense that we have no idea what direction we may be going in makes people scared and causes paralysis in which no one moves at all.

Several times this week while listening to Bloomberg radio, I heard of multiple Fortune 500 companies having developed multiple operating plans for 2013 based upon what outcome may arise out of Washington. Just think of the time and effort wasted on non-productive activities all because politicians can't come together and do what is in the best interest of the country and its people.

While perplexing as all of this may be, the equity markets have stared this adversity down for the better part of the year and especially over the past two weeks. Friday was a bit of a wake up call as the markets began to pull back sharply on news that a deal as it stands today is not likely to happen. The so called "Plan B" of the Republican party blew up in their faces leaving the Democrats holding all of the cards and not needing to make any moves themselves so that they can blame the other party and vice verse.

We at DWCM are still amazed that the markets have down as well as they have in the face of all of this uncertainty. Of the four equity benchmarks that we compare ourselves against, all but the DJIA will likely finished the year with double digit returns. Even the DJIA will likely produce a high single digit return. Currently the DWCM Fund stands a return above 20% besting all four indices.

The next week could be one of the most volatile trading week of the year for a few reasons. One, most traders and institutional players are off this week which creates extremely low trading volumes which could swing prices in either direction. Second, and likely the biggest driver will be if any deal is reached in Washington. If no deal is reach expect a decent sell off that could linger into the new year. Even if a patch work deal is put together, people may not be fooled and a sell off could still ensue.

We plan to take a cautious approach this week and and pay close attention to our current long-term positions that we would be adding additional capital to in the event of a sell off. In addition, we will be monitoring our current watchlist (which we will update on our website today) for those positions that we would like to bring on as part of our long-term strategy as well.

We believe that currently it is just too hard to determine in the short-term what direction the markets may be headed in which is why we will be focusing in on the long-term side of our portfolio.

The Week Ahead

As we noted previously, we expect that this could be a very volatile week within the equity markets. In addition to shortened trading hours on Monday and closed for Christmas on Tuesday, the rest of the week will be full of political conversations and "what if" scenarios. However, don't loose site of some very important economic data to be released most centered around the housing market.

- Mon - Markets close early

- Tue - Merry Christmas

- Wed - S&P Case-Shiller HPI, Richmond Fed Manufacturing Index

- Thu - Jobless Claims, New Home Sales, Consumer Confidence

- Fri - Chicago PMI, Pending Home Sales Index

We at DreamWorks Capital Management would like to wish everyone a safe and happy holiday season.

DreamWorks Capital Management

If you are currently trying to develop your own investment plan or are seeking the help of a professional investment advisor we urge you to give us the opportunity to show you what DWCM can do for you. No matter what stage in life you are currently at, DWCM can help you plan for your ever changing needs.

DWCM can you help you with any of the steps in your wealth management journey including;

- Addressing emergency fund needs

- Developing a retirement plan

- Sending a child to college

- Looking at various investment options

- Determining how to involve philanthropic passions as apart of your planning process

With our "SMART Principles", we can help you develop your unique goals and create a focused customized plan to achieve your financial and lifestyle goals.

Thursday, December 20, 2012

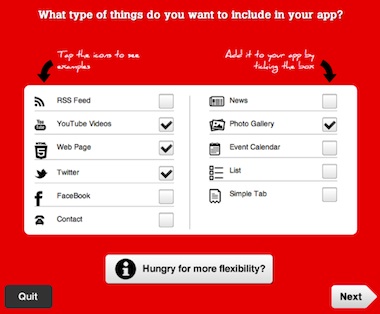

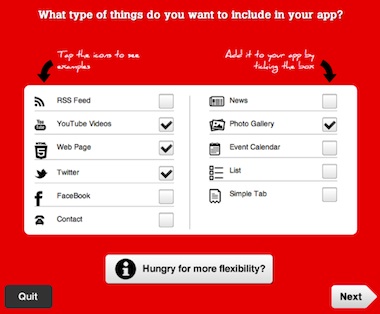

Make An iPhone, Android App Without Knowing A Line Of Code

Have you ever wanted to build your own App? Well, this article may help get you on your way. The App Builder by JamPot, allows you to build a genuine iPhone or Android app in mere minutes for free--according to the company's own website.

For more details check out the company's website here and this Fast Company article which provides additional details.

For more details check out the company's website here and this Fast Company article which provides additional details.

- The idea behind TheAppBuilder, JamPot's VP of Sales Matthew David explained to Fast Company, is simple. By using its web interface, pretty much anyone, no matter their coding expertise, can create a smartphone app and have it running on their device within minutes. They're not web apps, not a clever HTML5 app-like experience--they're genuine native apps, optimized for each platform's particular foibles. And within a couple of weeks, makers expect TheAppBuilder to support Windows Phone 7 with all the, as David phrased it, "fantastic" attributes of Metro.

The No-Hour Workweek: Reinventing Employee Expectations For The Modern Economy

Does work ever really stop? The answer to that is really no. This Fast Company article outlays how some companies are re-configuring their work weeks in order to help better support their employees and still get the job done.

- Technology means we’re permanently plugged in. Encouraging shorter hours sounds great in theory, but in reality it would likely just look good on paper. Everyone would still work all the time.

- Respect: Being connected 24/7 does not mean you place unrealistic demands on each other. If something is urgent, we treat it as such, but we don’t expect an immediate response on every item. We’ve hired people that respect each other and work as a team. They understand how to balance the priorities of our business with the various commitments and needs of their colleagues. Without this understanding, the No-Hour Workweek would spiral out of control.

Wednesday, December 19, 2012

Why Washington Has It Wrong on Small Business

Trying to understand and gauge small businesses in America can be quite the challenging task namely because all small businesses typically get lumped together no matter if you have 1 employee or 400 employees. The government takes a broad brush stroke to dealing with small businesses which can mean a disaster for some and a strategic advantage for others.

This WSJ article takes a specific look at how the government treats small businesses and what they get wrong in trying to apply the same policies and procedures to all.

This WSJ article takes a specific look at how the government treats small businesses and what they get wrong in trying to apply the same policies and procedures to all.

- The government, though, lumps them all into one category, covered by the same rules, policies and federal agency. Generally speaking, if you have fewer than 500 employees, you're a generic "small business"—whether you're the dry cleaner who's been on the same corner for a decade or a tech company that just launched in a dorm room.

- Small companies create enormous numbers of jobs, but those gains are driven by a handful of startups that actually grow big. Most small businesses start small and stay that way.

- Less than a quarter of America's 27 million small businesses have employees. An even smaller portion grow beyond 20 employees. And many of them don't want to. New research from the University of Chicago finds that 75% of small-business owners aren't aiming for growth at all. They're basically just looking for a steady job as their own boss.

How to Devise Passwords That Drive Hackers Away

Cyber security is something that most of us likely take for granted until something happens to us, then it becomes personal. Even those that take above average precautions are likely to be targeted as well. This is one reason why we encourage people to take a look at their credit report at least annually or even semi-annually. Everyone is entitled to one free annual credit report each year but if you would actually like to receive a credit score that is something that you are gong to have to pay for. However for the relatively small costs it could be well worth it.

We had a post earlier this year How Not to Become Mat Honan: A Short Primer on Online Security, which featured a writer at Wired Magazine who shared his experience getting hacked. Today we feature this article by NYT writer Nicole Perlroth, who discusses how to devise passwords to keep hackers away. Perloth names about half a dozen suggestions that could be helpful but the two that I find especially beneficial are...

We had a post earlier this year How Not to Become Mat Honan: A Short Primer on Online Security, which featured a writer at Wired Magazine who shared his experience getting hacked. Today we feature this article by NYT writer Nicole Perlroth, who discusses how to devise passwords to keep hackers away. Perloth names about half a dozen suggestions that could be helpful but the two that I find especially beneficial are...

- NEVER USE THE SAME PASSWORD TWICE

- STORE YOUR PASSWORDS SECURELY

- It is absurdly easy to get hacked. All it takes is clicking on one malicious link or attachment. Companies’ computer systems are attacked every day by hackers looking for passwords to sell on auctionlike black market sites where a single password can fetch $20. Hackers regularly exploit tools like John the Ripper, a free password-cracking program that use lists of commonly used passwords from breached sites and can test millions of passwords per second.

The U.S. Drought Is Hitting Harder Than Most Realize

Although it may be winter and people may have lost sight of the drought situation that ravaged most of the country throughout the year and especially the summer, it still continues.

Just take a look at most of the country today and what is missing....snow. I live in Michigan and we are finally waiting for our first meaningful snowfall this Friday. Snow is a very critical component of our water supply system. And personally, if it is going to be snow, we would like to have some snow to go with it.

Chris Martenson PhD, writes an update on this subject in the Financial Sense here. As Martenson highlights in his piece, lack of water has an impact of many more items that grain prices alone.

Just take a look at most of the country today and what is missing....snow. I live in Michigan and we are finally waiting for our first meaningful snowfall this Friday. Snow is a very critical component of our water supply system. And personally, if it is going to be snow, we would like to have some snow to go with it.

Chris Martenson PhD, writes an update on this subject in the Financial Sense here. As Martenson highlights in his piece, lack of water has an impact of many more items that grain prices alone.

- Even though the mainstream media seems to have lost some interest in the drought, we should keep it front and center in our minds, as it has already led to sharply higher grain prices, increased gasoline costs (via the pass-through of higher ethanol costs), impeded oil and gas drilling activity in some areas (due to a lack of water), caused the shutdown of a few operating electricity plants, temporarily reduced red meat prices (but will also make them climb sharply later) as cattle are dumped in response to feed- and pasture-management concerns, and blocked and/or reduced shipping on the Mississippi River. All this and there's also a strong chance that today's drought will negatively impact next year's Winter wheat harvest, unless a lot of rain starts falling soon.

Monday, December 17, 2012

Pimco: Strawberry Fields – Forever?

In Pimco's December monthly investment outlook piece, Bill Gross head of Pmico outlines some of the key issues facing the no growth economic scenario that we have talked about and featured in posts such as Granthom Q3 Letter and Face It: 2013 Is Gonna Be a Bummer.

Structural changes such as the big 4 if you will;

Structural changes such as the big 4 if you will;

- Debt/Delevering

- Globalization

- Technology

- Demographics

are all issues where there are no real solutions to help address or slow down the impediments to growth that each one creates in its own unique and distinct way.

The full Pimco article can be read here.

- As John Lennon forewarned, it is getting harder to be someone, and harder to maintain the economic growth that investors have become accustomed to. The New Normal, like Strawberry Fields will “take you down” and lower your expectation of future asset returns. It may not last “forever” but it will be with us for a long, long time.

Chart courtesy of Pimco

Leadership lessons from Nick Saban

One of my favorite tasks to engage in over the holidays is to catch up on my never ending list of articles, newsletters, and magazines that I fall behind on throughout the months. For those long time readers, you know that I am a die hard Notre Dame fan. I have been going to South Bend since the age of 7/8 and have had season football tickets for the past 10 years.

Although I have been patiently waiting for the past 25 years to reach the national championship game, I am most excited about playing Notre Dame's opponent Alabama. I have a tremendous amount of respect for the University of Alabama and more specifically their head football coach Nick Saban. His coaching role could match up easily with that of CEO from a Fortune 500 company.

What I especially like about Saban is his attention to detail and his ability to plan. Growing up I was instilled with this phrase from one of my early mentors, "plan the work, and work the plan." This is precisely Saban motto as well from what I have read about him.

So while I will be cheering hard for Notre Dame first football national championship in 25 years, I will still have respect for Alabama's head football coach Nick Saban.

Saban gave Fortune magazine full access to his lifestyle and approach earlier this year document in this article.

Although I have been patiently waiting for the past 25 years to reach the national championship game, I am most excited about playing Notre Dame's opponent Alabama. I have a tremendous amount of respect for the University of Alabama and more specifically their head football coach Nick Saban. His coaching role could match up easily with that of CEO from a Fortune 500 company.

What I especially like about Saban is his attention to detail and his ability to plan. Growing up I was instilled with this phrase from one of my early mentors, "plan the work, and work the plan." This is precisely Saban motto as well from what I have read about him.

So while I will be cheering hard for Notre Dame first football national championship in 25 years, I will still have respect for Alabama's head football coach Nick Saban.

Saban gave Fortune magazine full access to his lifestyle and approach earlier this year document in this article.

- If Saban were running a company instead of a football program, he'd be hailed as an elite manager. Alabama football is big business, and it has gotten only bigger under Saban. In 2006, the year before he arrived in Tuscaloosa, the athletic department brought in $67.7 million in revenue, mostly from football, and spent $60.6 million. Last year revenue was $124.5 million and expenditures were $105.1 million -- leaving a $19.4 million profit, according to figures compiled by USA Today. During Saban's tenure, Alabama has expanded the capacity of Bryant-Denny Stadium from 92,000 to 101,000, including the addition of new luxury (i.e., more expensive) seating. It was a no-brainer for the school to give him a two-year contract extension and healthy raise earlier this year. With a compensation package that averages $5.6 million a year over the next eight years, Saban is among the highest paid coaches in college football.

- What really separates Saban from the crowd is his organizational modus operandi. In Tuscaloosa they call it the Process. It's an approach he implemented first in turnarounds at Michigan State and LSU and seems to have perfected at Alabama. He has a plan for everything. He has a detailed program for his players to follow, and he's highly regimented. Above all, Saban keeps his players and coaches focused on execution -- yes, another word for process -- rather than results.

- Plenty of coaches are intense, and a lot of them work hard. In fact, most do. Where Saban stands apart is the execution at all levels of his operation. That means defining expectations for his players athletically, academically, and personally, and -- and this is critical -- always following through.

Sunday, December 16, 2012

How top executives live (Fortune, 1955)

This is a look back in time courtesy of Fortune.com and what the life of executive looked like in 1955. An executive at the top of his game (namely men at the time who held the top spots) was making a poultry $55k a year.

From the sounds of it an executive in 1955 was just as busy as an executive today without the hindrance of being connected to a mobile devise 24/7. In fact he had likely more in common with the common man than do many executives today just with a perk or two more.

Full Fortune piece here

From the sounds of it an executive in 1955 was just as busy as an executive today without the hindrance of being connected to a mobile devise 24/7. In fact he had likely more in common with the common man than do many executives today just with a perk or two more.

Full Fortune piece here

- The successful American executive, for example, gets up early--about 7:00 A.M.--eats a large breakfast, and rushes to his office by train or auto. It is not unusual for him, after spending from 9:00 A.M. until 6:00 P.M. in his office, to hurry home, eat dinner, and crawl into bed with a briefcase full of homework. He is constantly pressed for time, and a great deal of the time he spends in his office is extraneous to his business. He gets himself involved in all kinds of community work, either because he wants to or because he figures he has to for the sake of public relations.

- If he is a top executive he lives on an economic scale not too different from that of the man on the next-lower income rung. He surrenders around 40 per cent of his salary to the Bureau of Internal Revenue (he may cough up as much as 75 per cent) but still manages to put a little of his income in stocks, bonds, life insurance. He owns two cars, and gets along with one or two servants. What time he has left from his work--on weekends and brief vacations--he spends exercising, preferably outdoors, and usually at golf. Next to golf, fishing is the most popular executive diversion.

Grade Inflation: 5 States Where College Tuition Is Soaring

You may want to steer clear of these states when it comes to rising college costs according to this Smart Money article. Notice that the article talks about in-state costs. Remember for those of you looking at going to a school out of your home state, you can expect to pay almost double what the in-state rates are.

![[image]](http://s.wsj.net/public/resources/images/PF-AD033_smcoll_G_20120813154702.jpg)

- Average tuition and fees for in-state residents at public four-year colleges soared 16% to 21% last year in Arizona, California, Georgia and Washington, according to a report released last week by the College Board. (The average increase at public colleges over the same period was 8.3%; none of the figures in the report were adjusted for inflation.) What's more, students in some of those states may see more hikes in the upcoming year: Washington recently approved a tuition increase at several of its public universities, while California students may face another double-digit increase in the second semester of this academic year. "The potential for this to get worse is very real," says Rich Williams, higher education advocate at U.S. Public Interest Research Group.

- California

- Arizona

- Georgia

- Washington

- Neveda

![[image]](http://s.wsj.net/public/resources/images/PF-AD033_smcoll_G_20120813154702.jpg)

Saturday, December 15, 2012

Week 50 Performance..... Innocence Lost in Tragedy

It is with a heavy heart that I begin this weekly performance post. Having four small, unique, and special children of my own, the tragedy that occurred in Newtown, CT strikes extremely close to home. As I monitored the coverage throughout the day, my wife and I watched the events unfold in greater detail last evening and wondered what if those were our children? I'm sure that every parent was asking the same question but for those that wake up in Newtown this morning that thought is a reality and they must now figure out how to deal with this senseless tragedy.

I really don't know how you begin to explain to a child of 6, 7, or 8 years old what has transpired? Or how to explain to a sibling that their brother or sister will no longer be coming home? All we can do at this point is show support to those affected by this tragedy and try to explain to our children that there is more good than evil in this world.

As is the case we must now turn our attention to what has transpired with the capital markets this week.

All but the Russell 2000 index were down this week including the DWCM Fund. All equity markets were climbing higher throughout the week until Wednesday afternoon. This turn in markets coincided with the Fed press conference which obviously the markets did not like.

The Fed is in uncharted territory if you will writing it's own playbook on how to solve the US economic woes of stagnant growth, high unemployment, and a recovery that has been anemic at best especially given all of the stimulus pumped into the economy after the great recession began over 3 years ago.

At the heart of the issue is that the Fed is trying to solve something that it has no business trying to solve. The economy can not continue to function properly with the current mismanagement of the government. Whether or not we go over the fiscal cliff, the damage has likely already been done. Consumer and business confidence are so dampened that even if a deal is reached, it is not going to be the miracle that everyone may be expecting that turns things around.

There are serious structural problems that are facing this country that neither the Fed nor Congress can correct with monetary or fiscal policy. With rising debt levels, changes in both the manufacturing and service sectors, an education bubble ready to burst, and an aging population just to name a few, are certainly issues that cannot be adjusted easily. People must begin to look beyond the short-term window of what is happening in the next 1, 3, or 6 month periods but instead to what does our long-term future look like 10, 15, or 20 years from now if we continue to go down the reckless path we are currently on now?

We posted Jeremy Granthom's Q3 Newsletter in which he discuss these pertinent issues and the fact that we are running out of time fast to do something about them. It is a long read but well worth it so I urge each of you to take a look.

As we struggle getting to the finish line this year with our full year performance return, the last quarter has not been kind to the DWCM Fund nor the major equity indices. However, this week we made quite a few moves within the DWCM Fund to solidify both our short-term and long-term strategies.

When we first started the DWCM Fund nearly 2 years ago, one of our edicts was that we would own positions in our personal accounts that we owned within the Fund. We stated this because most mutual fund managers do not even own a stake in the vary fund that they manage themselves. We like to say here at DWCM that we eat our own cooking. We have a vested interest in the positions that we take on in both a personal and professional manor.

Below are the changes that occurred within the week and the reasoning behind the moves.

I really don't know how you begin to explain to a child of 6, 7, or 8 years old what has transpired? Or how to explain to a sibling that their brother or sister will no longer be coming home? All we can do at this point is show support to those affected by this tragedy and try to explain to our children that there is more good than evil in this world.

As is the case we must now turn our attention to what has transpired with the capital markets this week.

All but the Russell 2000 index were down this week including the DWCM Fund. All equity markets were climbing higher throughout the week until Wednesday afternoon. This turn in markets coincided with the Fed press conference which obviously the markets did not like.