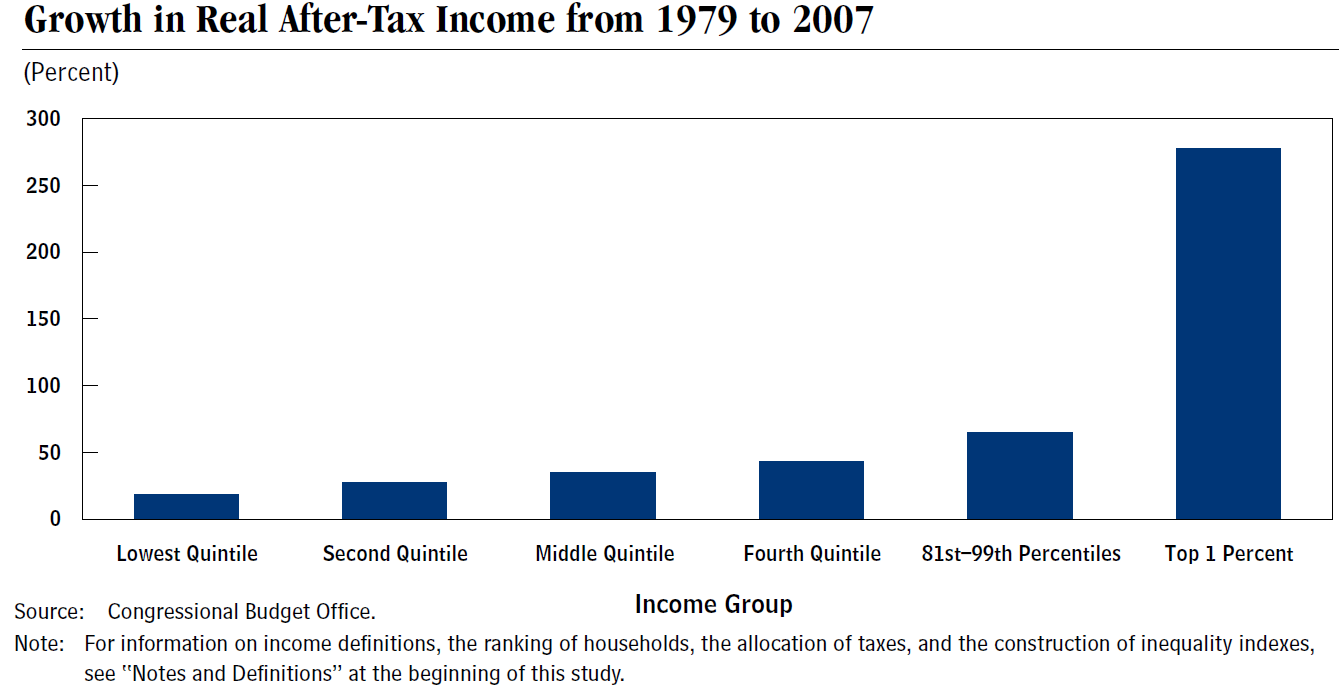

One of the issues we have had over the course of the past decade is how asset classes have started moving together meaning their correlations are moving towards 1 which is trouble for someone trying to diversify assets. Correlation was because a huge ordeal during the 08/09 crisis as people who thought that they were diversified when they held assets that were supposed to move in the opposite direct of the stock markets ended up going the same way which was in a downward trend.

The Capital Speculator has put together some additional charts one how correlations have started to come together

Correlations have also risen for REITs and U.S. stocks in recent years, with a similar story describing the relationship between commodities and U.S. stocks. A notable exception: correlations between U.S. stocks and U.S. bonds have fallen lately (as depicted by the red line in chart below).