If you actually have the time to go through this, even in a cursory view, there is allot of good data that gives you a sense of where the economy is at.

Thursday, August 30, 2012

Fed Beige Book

For your reading pleasure over the long Labor Day weekend in the US, I present to you the full detailed Beige Book from the Fed.

How Algorithms Rule The World

When Christopher Steiner, the 35-year-old cofounder of Aisle50, a Y Combinator startup offering online grocery deals, set out to write the book Automate This: How Algorithms Came to Rule Our World, (out tomorrow), he’d planned to focus solely on Wall Street. “There were a ton of good stories and then the Flash Crash happened. There was a lot to tell,” says Steiner. “But at some point I thought, ‘Do people really care about the 13 different electronic training networks that were going on in the 1990’s?’” Instead, the former technology journalist expanded his research to explore how the power of algorithms has spread far beyond Wall Street and now touches all of us--starting with today’s young innovators.

Full Fast Company interview here

Tuesday, August 28, 2012

US and Europe More and More Correlated

It's not just that the US equity market has a stronger correlation with the European equity markets, its that the US equities markets are becoming more correlated with most asset classes.

Chart Source: Bespoke

Chart Source: Bespoke

Monday, August 27, 2012

People Who Eat Breakfast Are Smarter And Skinnier

Although we may know that breakfast is the most important meal of the day, most Americans still do not get the day started eating breakfast. Several studies have proven the benefits of starting the day off with a good meal but obviously that data has not persuaded most people to change their eating habits.

Link to Fast Company source

Sunday, August 26, 2012

The Science Behind New Year’s Resolutions (and How to Use It to Achieve Yours)

Although the year is more than half way through I came across an article in my archive box that never made it into a post. Even though this article from Lifehacker specifically talks about new years resolutions the 4 rules below that the piece highlights are useful for planning a goal no matter what time of the year it is.

Full article here

Full article here

- Don't Keep Too Many Resolutions At Once

- Set (Very) Specific Goals

- Focus on the Carrot, Not the Stick

- Tell a Few Friends and Family Members

Saturday, August 25, 2012

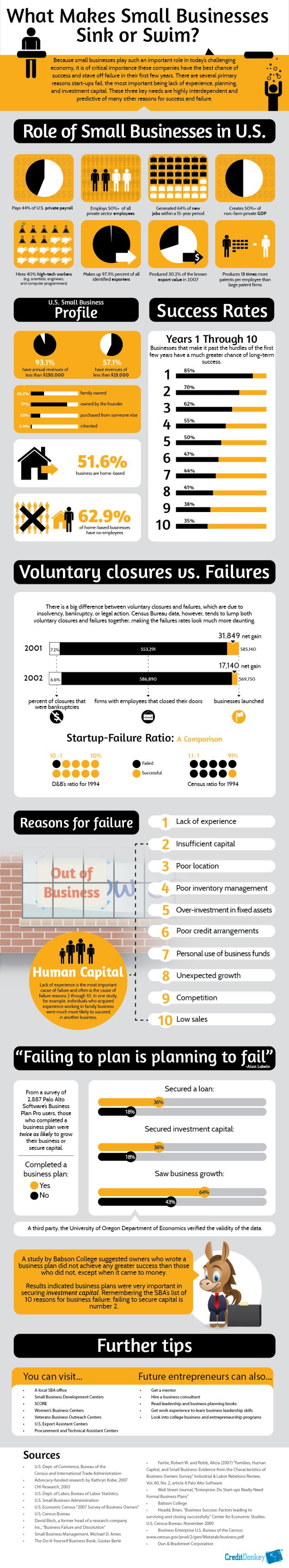

Circle Up: Crowdfunding Startup

Looking for alternative investments? A method of being able to get in on the ground floor of a company? Well crowdfunding may be an investment to consider. What is crowdfunding? Crowdfunding raises money for startup's and small companies. You basically become an angel investor.

So does how a person make money in this sort of investment? There are a few options when it comes private equity investing. A company that you invest in can either be sold to another company at a higher price or like a Facebook go through an IPO.

Circle Up specifically deals with consumer product businesses. Here is their website where you can gather more information. One thing that investors must consider in these types of alternative investments is the higher level of risk. Even a well vetted company still has the possibility to go bankrupt in which case you could very well loose your entire investment. Also is the lack of liquidity. Typically your investment is locked up for a given amount of time with a private equity type asset.

Again balance the risks with the rewards.

So does how a person make money in this sort of investment? There are a few options when it comes private equity investing. A company that you invest in can either be sold to another company at a higher price or like a Facebook go through an IPO.

Circle Up specifically deals with consumer product businesses. Here is their website where you can gather more information. One thing that investors must consider in these types of alternative investments is the higher level of risk. Even a well vetted company still has the possibility to go bankrupt in which case you could very well loose your entire investment. Also is the lack of liquidity. Typically your investment is locked up for a given amount of time with a private equity type asset.

Again balance the risks with the rewards.

A Field Guide to the Middle-Class U.S. Family

Interesting research from UCLA who studied 32 families in CA. The over riding factor in the study seemed to center around the dependence of children rather than the independence that parents strive to teach their children.

Among the findings according to this WSJ article

Among the findings according to this WSJ article

- The families had very a child-centered focus, which may help explain the "dependency dilemma" seen among American middle-class families, says Dr. Ochs. Parents intend to develop their children's independence, yet raise them to be relatively dependent, even when the kids have the skills to act on their own, she says.

- In addition, these parents tended to have a very specific, idealized way of thinking about family time, says Tami Kremer-Sadlik, a former CELF research director who is now the director of programs for the division of social sciences at UCLA. These ideals appeared to generate guilt when work intruded on family life, and left parents feeling pressured to create perfect time together. The researchers noted that the presence of the observers may have altered some of the families' behavior.

Week 34 Performance.....Indexes winning streak comes to an end but not DWCM

All four major indices finished down this week after a nearly 6 week run to the upside. The silver lining to the week was that the DWCM Fund continued it's hot streak up 6 weeks in a row.

The major news story of the week was the release of the FOMC minutes on Wednesday which indicated that the Fed again was standing ready to launch a new round of quantitative easing [see Fed Moving Closer to Action]. The Fed will be in the spotlight again this week as it gathers for it's annual conference in Jackson Hole, WY.

While widely speculated but still unknown, is weather the Fed will announce any news action plan at the conference. In years past, the Jackson Hole summit has been the launch point of major Fed actions such as QE 2 and Operation Twist.

Other economic data that had a direct impact on the DWCM Fund, was the release of additional home data. Via Barron's

The housing data has continued to put pressure on our short housing position which is now down almost 9% since we started it back in early July. The position represents a relatively small % of our overall DWCM portfolio at 2.3% so we are poised to ride this out for a little while longer. There may be some short-term headwinds to deal with it, but in the long-term we see increased pressures facing the housing recovery over the next 6 to 18 months.

We added one new position to the DWCM Fund this week which was Terra Nitrogen TNH. Terra produces liquid fertilizer and fits our long-term agriculture strategy. Terra pays a healthy dividend currently at 7.8% while holding a strong balance sheet and good growth prospects.

There were no sales this week in the Fund so our cash position now stands at 39.8% of the overall portfolio. This is a little lighter than we would like and we may take actions this week to increase our cash holdings.

The Week Ahead

As mentioned previously and last week as well, all eyes will be on the Fed summit which takes place towards the end of the week culminating in Bernanke's speech on Friday. The other major data point will be the release of GDP figures on Wednesday. Don't overlook the release of several sentiment surveys this week as they could drive intraday trading which could allow for some additional profit taking.

As we have pointed out in prior posts, if the Fed does not deliver what the market expects which at this point is likely another major QE program, look for the equity markets to drop significantly and give back a portion of their summer gains.

We will begin positioning the DWCM Fund over the weekend and early in the week to take risk off of the table. We would like to take our current cash position of 39.8% up to 50% prior to Friday. Even if the Fed does announce some program there is still a chance that the markets may not like what it hears. In our view at DWCM there is more risk to the downside than there is upside potential which is why we will begin to take a defensive approach and try to preserve capital.

The major news story of the week was the release of the FOMC minutes on Wednesday which indicated that the Fed again was standing ready to launch a new round of quantitative easing [see Fed Moving Closer to Action]. The Fed will be in the spotlight again this week as it gathers for it's annual conference in Jackson Hole, WY.

While widely speculated but still unknown, is weather the Fed will announce any news action plan at the conference. In years past, the Jackson Hole summit has been the launch point of major Fed actions such as QE 2 and Operation Twist.

Other economic data that had a direct impact on the DWCM Fund, was the release of additional home data. Via Barron's

- Existing home sales rebounded 2.3 percent in July to a 4.47 million annual rate in a gain that partially reverses a 5.4 percent decline in June. The annual rate hit its recovery peak in January this year as warm weather spurred counter-seasonal buying. July's gain was fed by price concessions with the median price down 0.8 percent to $187,300. Note that the median price is being held down by underperformance of lower priced sales. But the year-on-year median price rate, at plus 9.4 percent, is the best of the recovery and an indication of overall improvement for the market. Thin supply has been limiting sales in recent months and looks to be a continuing headwind. Supply relative to the sales rate is at 6.4 months, down from 6.5 months in June and compared against 9.3 months a year ago when distressed properties were flooding the market. In unit terms, unadjusted supply is 2.40 million units, up slightly from June's 2.37 million but down from May's 2.47 million.

|

We added one new position to the DWCM Fund this week which was Terra Nitrogen TNH. Terra produces liquid fertilizer and fits our long-term agriculture strategy. Terra pays a healthy dividend currently at 7.8% while holding a strong balance sheet and good growth prospects.

There were no sales this week in the Fund so our cash position now stands at 39.8% of the overall portfolio. This is a little lighter than we would like and we may take actions this week to increase our cash holdings.

The Week Ahead

As mentioned previously and last week as well, all eyes will be on the Fed summit which takes place towards the end of the week culminating in Bernanke's speech on Friday. The other major data point will be the release of GDP figures on Wednesday. Don't overlook the release of several sentiment surveys this week as they could drive intraday trading which could allow for some additional profit taking.

As we have pointed out in prior posts, if the Fed does not deliver what the market expects which at this point is likely another major QE program, look for the equity markets to drop significantly and give back a portion of their summer gains.

We will begin positioning the DWCM Fund over the weekend and early in the week to take risk off of the table. We would like to take our current cash position of 39.8% up to 50% prior to Friday. Even if the Fed does announce some program there is still a chance that the markets may not like what it hears. In our view at DWCM there is more risk to the downside than there is upside potential which is why we will begin to take a defensive approach and try to preserve capital.

- Mon - Dallas Fed Mfg Survey

- Tue - S&P Case-Shiller HPI, Consumer Confidence, Richmond Fed Manufacturing Index, State Street Investor Confidence Index

- Wed - GDP, Pending Home Sales Index, Beige Book

- Thu - Jobless Claims, Personal Income and Outlays, Kansas City Fed Manufacturing Index

- Fri - Speech, Chicago PMI, Consumer Sentiment, Factory Orders

Have a great week!

DreamWorks Capital Management

FREE LECTURE: Our next finance lecture will be on Tuesday September 18th at the The Community House. The topic will be Balancing Your Changing Investment Needs: Emergency Fund, Investments, Retirement, Education, and Philanthropy. We will cover significant points regarding creating, developing, and executing on your wealth management plan. We hope to have another interactive group, so be sure to sign up by emailing me directly at pfenner@dwcmllc.com or by contacting The Community House at 248-644-5832. There is no charge and light refreshments will be served.

FREE LECTURE: Our next finance lecture will be on Tuesday September 18th at the The Community House. The topic will be Balancing Your Changing Investment Needs: Emergency Fund, Investments, Retirement, Education, and Philanthropy. We will cover significant points regarding creating, developing, and executing on your wealth management plan. We hope to have another interactive group, so be sure to sign up by emailing me directly at pfenner@dwcmllc.com or by contacting The Community House at 248-644-5832. There is no charge and light refreshments will be served.

Friday, August 24, 2012

Mitt Romney: What I Learned at Bain Capital

Mitt Romney is featured in an op ed piece in the WSJ. You can read the full article here. I have highlighted some bullet points that I found interesting from the piece. The story centers around Romney's time at Bain Capital and how lessons learned there, will help make him a better President.

There are certainly issues in the private sector just as there are issues in the public sector. However if leaders were running the company more as a business or how 90% plus of Americans have to manage their own personal finances and affairs, Washington would be a vastly different place and IO doubt that we would have trillions in debt for generations to come.

You can read the full article here

There are certainly issues in the private sector just as there are issues in the public sector. However if leaders were running the company more as a business or how 90% plus of Americans have to manage their own personal finances and affairs, Washington would be a vastly different place and IO doubt that we would have trillions in debt for generations to come.

You can read the full article here

- A broad message emerges from my Bain Capital days: A good idea is not enough for a business to succeed. It requires a talented team, a good business plan and capital to execute it. That was true of companies we helped start, like Staples and the Bright Horizons child-care provider, and several of the struggling companies we helped turn around, like the Brookstone retailer and the contact-lens maker Wesley Jessen.

- My faith in people, not government, is at the foundation of my plan to strengthen America's middle class.

- I am committed to capping federal spending below 20% of GDP and reducing nondefense discretionary spending by 5%. This will surely result in much wailing and gnashing of teeth in Washington. But a failure of leadership has created our debt crisis, and ducking responsibility will only cripple the economy and smother opportunity for our children and grandchildren

Thursday, August 23, 2012

The 1% Captures Most Growth From Recovery

A study by Emmanuel Saez shows that in 2009 and 2010, the first year of the current “recovery” the one percent captured 93% of the income growth.

Here are the numbers:

CYCLE TOP 1% INCOME GROWTH 99% INCOME GROWTH

1993-2000 – 98.7% 20.3%

2001 Recession – (30.8%) (6.5%)

2002-2007 – 61.8% 6.8%

2007 Recession – (36.3%) (11.6%)

2009-2010 – 11.6% 0.2%

Source Data WSJ

Here are the numbers:

CYCLE TOP 1% INCOME GROWTH 99% INCOME GROWTH

1993-2000 – 98.7% 20.3%

2001 Recession – (30.8%) (6.5%)

2002-2007 – 61.8% 6.8%

2007 Recession – (36.3%) (11.6%)

2009-2010 – 11.6% 0.2%

Source Data WSJ

Wednesday, August 22, 2012

Fed Moving Closer to Action?

With the release of it's latest minutes, the FMOC looks poised to act again. At DWCM we have stated repeatedly that we are not in favor of any additional quantitative easing. From our view and analysis, additional QE will only add additional debt that the US cannot bear and that any additional benefit QE may provide will be fleeting at best and will not result in any significant long-term growth.

You can read the full release of the FMOC minutes here in PDF form. In addition the WSJ put out commentary here that summarizes the minutes.

![[image]](http://si.wsj.net/public/resources/images/P1-BH720_FED_NS_20120822184810.jpg)

You can read the full release of the FMOC minutes here in PDF form. In addition the WSJ put out commentary here that summarizes the minutes.

- "Many members judged that additional monetary accommodation would likely be warranted fairly soon unless incoming information pointed to a substantial and sustainable strengthening in the pace of the economic recovery," the minutes said.

So this sets us up for what could be an extremely volatile week next week in the equity markets. It is widely speculated that QE is already baked into the markets, hence the 10% increase in the major indexes the last few months. If the Fed does not deliver there could be a sharp decline. Or even if the Fed does act, if it does not provide the market with enough ammo or easing we could have a slide to the downside.

![[image]](http://si.wsj.net/public/resources/images/P1-BH720_FED_NS_20120822184810.jpg)

Home builders resistant

Toll brother reported a solid quarter today. What was probably more important than the actual numbers were the comments made by CEO Douglas Yearly. "We are enjoying the most sustained demand we have experienced in over five years." Yearly wen on to say, "The housing recovery is being driven by pent-up demand, very low interest rates and attractively priced homes."

The home builder stocks have been white iron hot. Needless to say we at DWCM have seen our short position in the home builders swing from profit to loss, loss to profit, and back to loss again. So far we are down 7.5% with the position which represents a 2% stake in the portfolio.

We are going to continue to let this story play out as we believe the wall of worry may be too high to climb with the looming fiscal cliff. It is always a good idea to also have some protection to the downside.

The home builder stocks have been white iron hot. Needless to say we at DWCM have seen our short position in the home builders swing from profit to loss, loss to profit, and back to loss again. So far we are down 7.5% with the position which represents a 2% stake in the portfolio.

We are going to continue to let this story play out as we believe the wall of worry may be too high to climb with the looming fiscal cliff. It is always a good idea to also have some protection to the downside.

What Successful People Do With The First Hour Of Their Work Day

Some people are morning people, while some are not. However according to this Fast Company article the first hour of the day may be the most important hour of the day. There is no doubt that getting off to a good start every day can set the table for the rest of the day. It can affect how much you get accomplished, what your mood will be like, or how you will treat other people.

Here are a few bullet points from the full article here

Here are a few bullet points from the full article here

- Don’t Check Your Email for the First Hour

- Gain Awareness, Be Grateful

- Do the Big, Shoulder-Sagging Stuff First

- Ask Yourself If You’re Doing What You Want to Do

- “Customer Service” (or Your Own Equivalent)

When I was 17, I read a quote that went something like: "If you live each day as if it was your last, someday you'll most certainly be right." It made an impression on me, and since then, for the past 33 years, I have looked in the mirror every morning and asked myself: "If today were the last day of my life, would I want to do what I am about to do today?" And whenever the answer has been "No" for too many days in a row, I know I need to change something.

~Steve Jobs

Drought Gets Its Close-Up .

A recent tour of America's heartland show some disastrous conditions in regards to crop production with some people seeing a 47% drop in output for corn and soybeans compared to last year.

We've already noted that if you have been paying to prices at the grocery stores in recent weeks you have already seen prices going up. Much like oil, food product and the costs of their inputs aren't as likely to head down as fats as they went up as the crisis subsides. This will likely result in continued pressures on consumers already trying to make it in a weak economy.

See full WSJ article

We've already noted that if you have been paying to prices at the grocery stores in recent weeks you have already seen prices going up. Much like oil, food product and the costs of their inputs aren't as likely to head down as fats as they went up as the crisis subsides. This will likely result in continued pressures on consumers already trying to make it in a weak economy.

See full WSJ article

Tuesday, August 21, 2012

Twitter, the Startup That Wouldn't Die

It will be interesting to see what comes of Twitter in the next year. Will it stay private or try it's hand in the public arena as Fcaebook has? If Facebook is any lesson, Twitter should wait until until they are fully ready and not try to muck up the first day IPO.

In the meantime, Businessweek had put out an article earlier this year which dives a little deeper into the company's workings.

Full article here

In the meantime, Businessweek had put out an article earlier this year which dives a little deeper into the company's workings.

Full article here

How to Fix Executive Compensation

It seems like the topic of executive pay comes in and out of the headlines ever so often. Just recently I saw a release of CEO's pay vs. what their companies paid in taxes. The list showed about that about 26 top executives made more than what their companies paid out in taxes.

This WSJ article looks specifically at three ways to pay CEO's in a smarter manner

![[image]](http://si.wsj.net/public/resources/images/LE-AA199_DEBTFA_NS_20120223124509.jpg)

This WSJ article looks specifically at three ways to pay CEO's in a smarter manner

![[image]](http://si.wsj.net/public/resources/images/LE-AA199_DEBTFA_NS_20120223124509.jpg)

Wall Street steps in when Ivy League fails

This was a very interesting article in the Washington Post that tackled the question as to the how and why students choose the finance field. According to the article it was necessarily the student choosing the profession but Wall Street choosing them

Here are some points that I gleaned from the Post article here

Here are some points that I gleaned from the Post article here

- What Wall Street figured out is that colleges are producing a large number of very smart, completely confused graduates. Kids who have ample mental horsepower, an incredible work ethic and no idea what to do next. So the finance industry takes advantage of that confusion, attracting students who never intended to work in finance but don’t have any better ideas about where to go.

- It begins by mimicking the application process that Harvard students have already grown comfortable with. “It’s doing a process that you’ve done a billion times before,” says Dylan Matthews, a senior at Harvard who was previously a researcher at the Washington Post.

- “Everyone who goes to Harvard went hard on the college application process,” he said. “Applying to Wall Street is much closer to that than applying anywhere else is. There are a handful of firms you really care about; they all have formal application processes that they walk you through; there’s a season when it all happens; all of them come to you and interview you where you live, etc. Harvard students are really good at formal processes like that, and they’re less good at going on Monster or Craigslist and sorting through thousands of job listings from thousands of companies whose reputations they don’t know. Wall Street and consulting (and Teach for America) turn applying to jobs into applying to college, more or less.”

- But that’s only half of it. The bigger draw, explained a recent Harvard graduate who majored in social science and went to Goldman Sachs for two years, is what Wall Street is selling to potential applicants. “It’s about squelching anxiety in general. It checks the job box. And it’s a low-risk opportunity. It’s a two-year program with a great salary and the promise to get these skills that should be able to transfer to a variety of other areas. The idea is that once you pass the test at Goldman, you can do anything. You learn Excel, you learn valuation, you learn how to survive intense hours and a high-pressure environment. So it seems like a good way to launch your career. That’s very appealing for those of us at Harvard who were not in pre-professional majors.”

Adulthood, Delayed: What Has the Recession Done to Millennials?

There are some definite headwinds facing America's youth right now. And quite frankly it's not just America's youth who are having trouble making the journey into independent adulthood, take a look at youth unemployment around the world, especially in Europe.

Facing growing college debt, higher unemployment, and pure financial uncertainty would make most people put off getting marriage, buying a house, or purchasing some other large ticket item such as a car.

As this Atlantic piece points out and I wonder as well is, is Generation Y as they are called, delaying adulthood intentionally or are these headwinds too much to overcome? Every generation has it's own unique set of challenges so it will be interesting to see how this group of young people handle the challenge

Full article here

Facing growing college debt, higher unemployment, and pure financial uncertainty would make most people put off getting marriage, buying a house, or purchasing some other large ticket item such as a car.

As this Atlantic piece points out and I wonder as well is, is Generation Y as they are called, delaying adulthood intentionally or are these headwinds too much to overcome? Every generation has it's own unique set of challenges so it will be interesting to see how this group of young people handle the challenge

Full article here

- Why won't Millennials grow up? The biggest reason is they can't, according to the Pew Research Center's fantastic new survey "Young, Underemployed, and Optimistic." It begins with school.

- Average debt for public college students doubled between 1996 and 2006. It's less advisable to invest in marriage with $30,000 in student debt as a couple. "More than one-in-five young adults ages 18 to 34 (22%) say they have postponed having a baby because of the bad economy," Pew reported. "Roughly the same proportion say they have postponed getting married."

- If school years delayed financial independence, the Great Recession just about shattered it. Due to economic conditions, 24% of young adults have moved back in with their parents for a significant period of time. "Among those ages 25 to 29, the share moving back home rises to 34%," Pew reports. One in three!

- Some people liken a career path to a staircase.... The burden of climbing has increased. The rewards have declined.

Monday, August 20, 2012

Obama, Explained

This is a rather lengthy article in the Atlantic which profiles President Obama. Whether you like the President or not, this gives a good perspective of his presidency.

As Barack Obama contends for a second term in office, two conflicting narratives of his presidency have emerged. Is he a skillful political player and policy visionary—a chess master who always sees several moves ahead of his opponents (and of the punditocracy)? Or is he politically clumsy and out of his depth—a pawn overwhelmed by events, at the mercy of a second-rate staff and of the Republicans? Here, a longtime analyst of the presidency takes the measure of our 44th president, with a view to history.

Full article here

As Barack Obama contends for a second term in office, two conflicting narratives of his presidency have emerged. Is he a skillful political player and policy visionary—a chess master who always sees several moves ahead of his opponents (and of the punditocracy)? Or is he politically clumsy and out of his depth—a pawn overwhelmed by events, at the mercy of a second-rate staff and of the Republicans? Here, a longtime analyst of the presidency takes the measure of our 44th president, with a view to history.

Full article here

The Mystery Monk Making Billions With 5-Hour Energy

Although I have never tried a 5-Hour Energy drink, there is no doubt about it's popularity. Who you may not know, is the person behind the drink. Manoj Bhargava, the creator of drink and head of privately held Living Essentials, parent of the popular drink.

Headquartered in Farmington Hills, MI, the low key Bhargava does his best to keep out of the spotlight. Bhargava, 58, barely registers on Web searches. His paper trail is thin, consisting primarily of more than 90 lawsuits and this Forbes article was his first press interview.

Full article here

Headquartered in Farmington Hills, MI, the low key Bhargava does his best to keep out of the spotlight. Bhargava, 58, barely registers on Web searches. His paper trail is thin, consisting primarily of more than 90 lawsuits and this Forbes article was his first press interview.

Full article here

- The privately held Living Essentials doesn’t report revenue or profits, but a source with knowledge of its financials says the company grossed north of $600 million last year on that $1 billion at retail. The source says the company netted about $300 million. Checkout scan data from research firm SymphonyIRI say that 5-Hour has 90% of the energy-shot market. Its closest competitor, NVE Pharmaceuticals’ Stacker brand, has just over 3%.

- Colleagues and acquaintances uniformly describe Bhargava as “humble,” and he seems proud of his frugal lifestyle: his ancient flip phone, his cheap office furniture, the modest two-story home he shares with his wife and 20-year-old son.

- The rise of 5-Hour began in the spring of 2003, when Bhargava found himself at a natural products trade show in Anaheim, Calif. At one booth the sales reps peddled a 16-ounce concoction claiming to boost productivity for hours. Bhargava took a swig. “For the next six or seven hours I was in great shape,” he says. “I thought, Wow, this is amazing. I can sell this.”

|

| Manoj Bhargava. Photo by Eric Eggley. |

A Generation Hobbled by the Soaring Cost of College

What really startles me about the increasing levels of college debt is that parents and students don't seem to be aware of the costs. As I began reading this NYT piece, A Generation Hobbled by the Soaring Cost of College the first issue that stood out to me was the story of Kelsey Griffith, graduate of Ohio Northern University.

“As an 18-year-old, it sounded like a good fit to me, and the school really sold it,” said Ms. Griffith, a marketing major. “I knew a private school would cost a lot of money. But when I graduate, I’m going to owe like $900 a month. No one told me that.”

How does one not realize how much the cost of college is when they sign up for the loans? However this happens to thousands of people across the country as they sign up for schools that they simply cannot afford. As Griffith noted, when she visited Ohio Northern, she was won over by faculty and admissions staff members who urge students to pursue their dreams rather than obsess on the sticker price.

Just because you visit a college and fall in love with it doesn't mean that you should go there. Parents and students should do their home work before visiting any college which would include a cost analysis.

Full NYT story here

“As an 18-year-old, it sounded like a good fit to me, and the school really sold it,” said Ms. Griffith, a marketing major. “I knew a private school would cost a lot of money. But when I graduate, I’m going to owe like $900 a month. No one told me that.”

How does one not realize how much the cost of college is when they sign up for the loans? However this happens to thousands of people across the country as they sign up for schools that they simply cannot afford. As Griffith noted, when she visited Ohio Northern, she was won over by faculty and admissions staff members who urge students to pursue their dreams rather than obsess on the sticker price.

Just because you visit a college and fall in love with it doesn't mean that you should go there. Parents and students should do their home work before visiting any college which would include a cost analysis.

Full NYT story here

Sunday, August 19, 2012

What happens when all markets and asset classes are in correlation?

The presentation below is courtesy of Barry Ritholtz of The Big Picture. As Barry point out below, stock correlations are at an all time high. What does this mean? It means that there are really no safe places to hide. Many people found this out the hard way in 2008 when they thought that they were protected being in real estate, commodities, or even gold. Only to see all of those assets go down with the overall market as well.

5 Lessons For Using Open Innovation To Maximize The Wisdom Of The Crowd

According to this Fast Company piece the next innovation breakthrough won't come from a single individual but from a group. The future of innovation is in the crowd, and by using a big group’s best ideas, you can find the best way to solve any problem.

The article goes on to state, " today everybody seems to try to emulate the genius of Steve Jobs, not realizing that he’s the outlier. But there is a different way, a way that has brought us many breakthrough inventions in fields as far reaching as technology, sports, and medicine. That way is open innovation."

Below are 5 lessons in using open innovation via Fast Company

The article goes on to state, " today everybody seems to try to emulate the genius of Steve Jobs, not realizing that he’s the outlier. But there is a different way, a way that has brought us many breakthrough inventions in fields as far reaching as technology, sports, and medicine. That way is open innovation."

Below are 5 lessons in using open innovation via Fast Company

- SUPERIOR PRODUCTS MATTER

- PUSH (MOST) DECISION MAKING TO THE EDGES

- COMMUNICATION IS KEY

- MAKE IT EASY

- COMMUNITIES ARE NOT MARKETS; MEMBERS ARE CITIZENS

|

Saturday, August 18, 2012

Week 33 Performance.....Hot summer rally continues to blister

Despite not having any key economic data driving the markets this week, nor any major headlines coming out of Europe, the equity markets put on a solid rally to the upside this week adding to it's hot streak since the spring swoon in May and June.

The DWCM Fund was up 3% this week far outpacing the four major indices. Technology continues to lead the way in this rally as the NASDAQ was up 1.8% for the week and is currently beating the other 3 major equity benchmarks anywhere from 6% to 10% for the year.

Apple AAPL on Friday hit an all time high while Google GOOG touched it's 52 week high this week. We continue to maintain our large position in Apple and hold an option position in Google.

The agriculture names such as Mosaic MOS, Monsanto MON, and Potash POT continue to outperform as well despite the drought conditions that continue to deteriorate the commodity crops especially corn. Deere DE reported an awful quarter this week and at one point was down over 6% on the week but rallied to close down about 3%. Although Deere sales were largely in line with estimates, earnings were not in which the company cited weakness in Europe as the main culprit.

We continue to see agriculture as a great place to be despite the run up in stock prices. However we would suggest adding to positions slowly or waiting for a pull back before committing any meaningful capital.

As we noted last week we thought that retail sales would be a key driver for the markets which on the surface seemed to be the case. Retail sales rose sharply to the upside although comps vs. last month were very week. It's hard to tell weather this means a turn in the data or a one time blip. Looking at the chart below the trend has definitely been to the downside. And as food prices continue to push higher, oil over $90 a barrel, and gas hitting $4 across the country due to refinery issues, the consumer faces an uphill battle.

The markets in general in our view continue to feel over heated in the face of the strong headwinds such as the Presidential election, looming fiscal cliff, and European debt crisis. The markets may have likely priced in the kicking of these problems down the road further in which case any hiccup or failed attempts to stop any carnage could prove detrimental to stock prices.

Again we stress the balance of being cautiously in the market while have ample capital sitting on the sidelines.

As much as we like Disney DIS, we saw that it was time to take profits in our option position. The downfall of owning any option position in the Investopedia simulation is that you can only sell the position to close it out rather than also having the option to exercise the position and own the stock outright. If we had that option, we would have exercised the options thus buying the stock at a price lower than the price today and then selling part of it to lock in some profits and held onto a smaller position.

Disney, like so many other stocks during this summer, has rallied and reached a point of full valuation in our opinion and could get hurt in any meaningful market pull back. We will continue to watch Disney as this would be a potential core position that we would like to own for the long-term at a reasonable price.

Our cash position % wise finished unchanged week over week at 42.2% which we consider somewhat healthy. Ideally we would like to get that pushed back up to 50% as we approach the volatile fall season and the economic headwinds looming on the horizon.

The Week Ahead

We are in store for another light week of economic data especially during the early portion of the week. Look for rumors to begin peculating as people look forward to the annual Fed meeting in Jackson Hole, WY next week. This meeting has been the site for some major Fed announcement over the past few years which has led to large amounts of stimulus being handed out. If nothing comes out of this event the last week of August, look for a possible major pull back in the equity markets.

The DWCM Fund was up 3% this week far outpacing the four major indices. Technology continues to lead the way in this rally as the NASDAQ was up 1.8% for the week and is currently beating the other 3 major equity benchmarks anywhere from 6% to 10% for the year.

Apple AAPL on Friday hit an all time high while Google GOOG touched it's 52 week high this week. We continue to maintain our large position in Apple and hold an option position in Google.

The agriculture names such as Mosaic MOS, Monsanto MON, and Potash POT continue to outperform as well despite the drought conditions that continue to deteriorate the commodity crops especially corn. Deere DE reported an awful quarter this week and at one point was down over 6% on the week but rallied to close down about 3%. Although Deere sales were largely in line with estimates, earnings were not in which the company cited weakness in Europe as the main culprit.

We continue to see agriculture as a great place to be despite the run up in stock prices. However we would suggest adding to positions slowly or waiting for a pull back before committing any meaningful capital.

As we noted last week we thought that retail sales would be a key driver for the markets which on the surface seemed to be the case. Retail sales rose sharply to the upside although comps vs. last month were very week. It's hard to tell weather this means a turn in the data or a one time blip. Looking at the chart below the trend has definitely been to the downside. And as food prices continue to push higher, oil over $90 a barrel, and gas hitting $4 across the country due to refinery issues, the consumer faces an uphill battle.

| Source Barron's |

The markets in general in our view continue to feel over heated in the face of the strong headwinds such as the Presidential election, looming fiscal cliff, and European debt crisis. The markets may have likely priced in the kicking of these problems down the road further in which case any hiccup or failed attempts to stop any carnage could prove detrimental to stock prices.

Again we stress the balance of being cautiously in the market while have ample capital sitting on the sidelines.

As much as we like Disney DIS, we saw that it was time to take profits in our option position. The downfall of owning any option position in the Investopedia simulation is that you can only sell the position to close it out rather than also having the option to exercise the position and own the stock outright. If we had that option, we would have exercised the options thus buying the stock at a price lower than the price today and then selling part of it to lock in some profits and held onto a smaller position.

Disney, like so many other stocks during this summer, has rallied and reached a point of full valuation in our opinion and could get hurt in any meaningful market pull back. We will continue to watch Disney as this would be a potential core position that we would like to own for the long-term at a reasonable price.

Our cash position % wise finished unchanged week over week at 42.2% which we consider somewhat healthy. Ideally we would like to get that pushed back up to 50% as we approach the volatile fall season and the economic headwinds looming on the horizon.

The Week Ahead

We are in store for another light week of economic data especially during the early portion of the week. Look for rumors to begin peculating as people look forward to the annual Fed meeting in Jackson Hole, WY next week. This meeting has been the site for some major Fed announcement over the past few years which has led to large amounts of stimulus being handed out. If nothing comes out of this event the last week of August, look for a possible major pull back in the equity markets.

- Mon - Chicago Fed National Activity Index

- Tue - ICSC-Goldman Store Sales

- Wed - Existing Home Sales, FOMC Minutes

- Thu - Jobless Claims, PMI Manufacturing Index Flash, New Home Sales, FHFA House Price Index

- Fri - Durable Goods Orders

Have a great week!

DreamWorks Capital Management

FREE LECTURE: Our next finance lecture will be on Tuesday September 18th at the The Community House. The topic will be Balancing Your Changing Investment Needs: Emergency Fund, Investments, Retirement, Education, and Philanthropy. We will cover significant points regarding creating, developing, and executing on your wealth management plan. We hope to have another interactive group, so be sure to sign up by emailing me directly at pfenner@dwcmllc.com or by contacting The Community House at 248-644-5832. There is no charge and light refreshments will be served.

FREE LECTURE: Our next finance lecture will be on Tuesday September 18th at the The Community House. The topic will be Balancing Your Changing Investment Needs: Emergency Fund, Investments, Retirement, Education, and Philanthropy. We will cover significant points regarding creating, developing, and executing on your wealth management plan. We hope to have another interactive group, so be sure to sign up by emailing me directly at pfenner@dwcmllc.com or by contacting The Community House at 248-644-5832. There is no charge and light refreshments will be served.

Friday, August 17, 2012

GameStop: Buy or Value Trap

Over the Weekend, Barron's had a featured article about GameStop GME, the video game retailer. GameStop (which I personally owned a few years ago), has been on a steep decline since 2008. From a relative and fundamental standpoint the stock looks cheap. It has do debt, generates cash, has a P/E below 6, and pays out a 3.6% dividend yield. Sounds great, so what's the catch?

In our view the catch is that the stock does not have a catalyst to drive it higher. To us this what some people call a "classic value trap". All of the numbers look great but the company has no driver to push the price higher. People are buying games online and/or are going to other retailers who have stepped up this game in this budding industry.

As the Barron's article points out the only hope or catalyst to drive the stock higher is a potential buyout which we see currently going on at Best Buy BBY. However as we all know hope should never be an investment strategy.

In our view the catch is that the stock does not have a catalyst to drive it higher. To us this what some people call a "classic value trap". All of the numbers look great but the company has no driver to push the price higher. People are buying games online and/or are going to other retailers who have stepped up this game in this budding industry.

As the Barron's article points out the only hope or catalyst to drive the stock higher is a potential buyout which we see currently going on at Best Buy BBY. However as we all know hope should never be an investment strategy.

| Recent | 12-Mo | 2012E | Market | Div | ||

| Company/Ticker | Price | Chg | EPS | P/E | Val (bil) | Yld |

| Best Buy /BBY | $19.19 | -20.3% | $3.76 | 5.1 | $6.8 | 3.5% |

| GameStop/GME | 16.83 | -18.1 | 3.15 | 5.3 | 2.2 | 3.6 |

| E=Estimate. | Source: Thomson Reuters | |||||

Thursday, August 16, 2012

Industrial Production and Capacity Utilization

By looking at industrial production and capacity utilization you would think that the economy is on somewhat stable ground. The Fed released the data here which shows a rise in industrial production and an increase in capacity.

Production has been up in 5 of the past 6 months while capacity, currently at 79.3% is approaching the long term average of 80.3%. We've come a long ways since the 2009 low is 66% capacity utilization.

You would think that with these steady gains in production it would have created more jobs. However as we have noted before productivity although slowing is still producing meaningful gains. Also rather than hiring people, companies are working their employees longer.

PDF version here

Production has been up in 5 of the past 6 months while capacity, currently at 79.3% is approaching the long term average of 80.3%. We've come a long ways since the 2009 low is 66% capacity utilization.

You would think that with these steady gains in production it would have created more jobs. However as we have noted before productivity although slowing is still producing meaningful gains. Also rather than hiring people, companies are working their employees longer.

PDF version here

SEO Isn't What You Think It Is

Those of you who own your own business or have blog sites may be interested in this Fast Company article which details how to draw more attention or optimize your space via Google. As the article points out you have to do more than put up who you are and what you do. The real spark that helps get you atop the Google search results is being engaged with people. The more people that find you interesting and what to know about you, the higher you will rank in the Google searches.

Below are some channels per the article here that may help you out.

Below are some channels per the article here that may help you out.

- Facilitate conversations with fans on your Facebook page

- Share tweets about topics of interest (again--not self-serving announcements but follower-serving news) via Twitter

- Uploading shareable videos to your YouTube channel optimizes your brand as well as your website

- Pin and Repin interesting visuals on Pinterest

- Participate in groups, answer questions, and post company updates on LinkedIn

- Share information on Google+

Apple's New Front in Battle for TV

If Apple can do what it in essence did in the music industry by getting streaming video, cable, and DVR movies all together on one device then look out. The problem is, everyone has seen what Apple has done with the music industry which it has basically taken control of and the cable operators don't want that to happen to them.

Article here via the WSJ

Article here via the WSJ

- The talks illustrate that Apple is seeking a less radical path to expand in television than it has contemplated in the past, namely teaming up with existing service providers rather than licensing content to compete with them directly.

- By building a set-top box that could be used with cable operators, Apple would be following a similar playbook that it used to transform the mobile-phone industry: convincing existing service providers to marry their service with Apple's hardware and software.

- Cable operators have also been put off in the past by Apple's demand for a 30% cut on certain transactions going through the box, according to a person familiar with the situation. Apple has also discussed wanting to be the exclusive provider of set-top boxes using Internet Protocol technology, the person said. And it wanted the cable operators to service the box.

- For cable operators, the advantage of a deal with Apple is that it could allow them to reduce the money they spend buying set-top boxes, which are leased to customers for a monthly fee. It could also help them hang on to customers who can watch video through a growing array of Internet alternatives, as both traditional TV and Web video would be available through the same device.

Wednesday, August 15, 2012

The 100 Most Creative People in Business

Fast Company is out with it's annual list of The 100 Most Creative People in Business. The list is very diverse from rock stars, to CEO's, to marketeers. There is probably something on this list for everyone.

|

The 100 Rules for Being an Entrepreneur

It's been a while since we've posted anything from our friend James Altucher. This is an older post that James had put together about being an entrepreneur.

- If you Google “entrepreneur” you get a lot of mindless cliches like “Think Big!” For me, being an “entrepreneur” doesn’t mean starting the next “Faceook”. Or even starting any business at all. It means finding the challenges you have in your ife, and determining creative ways to overcome those challenges. However, in this post I focus mostly on the issues that come up when you first start your company. These rules also apply if you are taking an entrepreneurial stance within a much larger company (which all employees should do).

Monday, August 13, 2012

Jim O’Neill Picks the Next BRICs

Jim O’Neill, creator of the BRIC acronym (Brazil, Russian, India, and China) 10 years ago, is positive on the prospects of the BRIC economies but also of other “growth” markets such as Turkey and Mexico. He talks to Tracy Corrigan, Editor-in-Chief of The Wall Street Journal Europe.

Ratigan: Interests of Corporation Not Aligned with American People

Dylan Ratigan was one of my favorite reporters when he was on CNBC. He is now on MSNBC which I really don't watch. However, sometimes I will find highlights of his like the video below. Ratigan is not one to mince words.

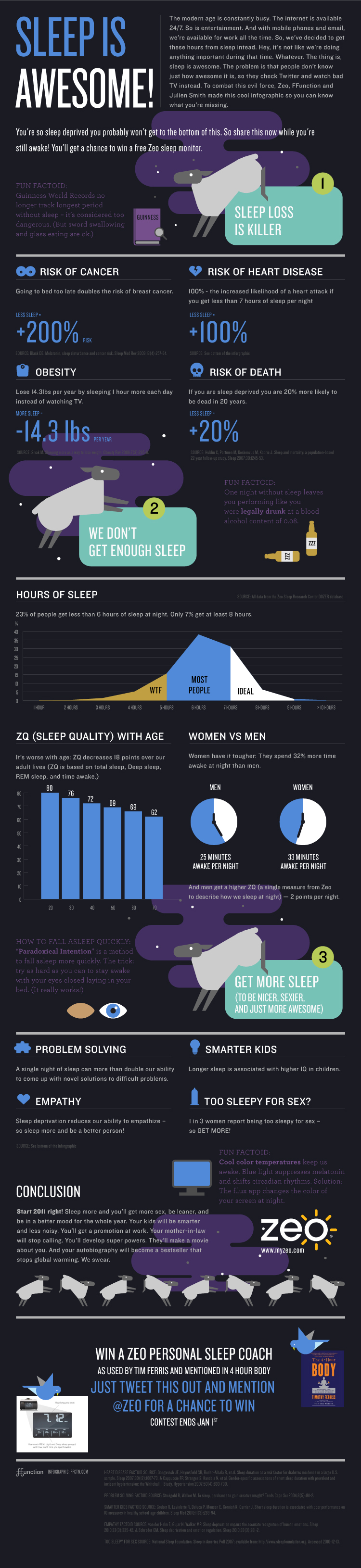

Sleep is Awesome!

Sunday, August 12, 2012

DWCM Q2 2012: What Sets Investors’ Results Apart

DWCM friends, clients, and readers,

Please find attached DreamWorks Capital Management 2nd Quarter Investment Newsletter.

I can remember various times in the markets over the course of the past few decades where investing looked easy. A situation where rising tides would lift all boats or in these cases all stock prices. The late 90’s during the Dotcom bubble, the period after the great recession and to some degree the first quarter of 2012 are all examples.

A decent stock picker can make just as many good picks as a bad stock picker in a bull market. One of the skills that sets a great investor apart from the crowd is the ability to know when and how to diversify one’s assets. Knowing when to be invested is just as important as knowing when not to be invested.

Investing is not about trying to time the markets. At DWCM we focus on having a core foundation of assets around which to build a strategy, and then look for pockets of opportunities for investment. People can become their own worst enemy when it comes to investing, which is the basis for our case study this quarter.

Please find attached DreamWorks Capital Management 2nd Quarter Investment Newsletter.

I can remember various times in the markets over the course of the past few decades where investing looked easy. A situation where rising tides would lift all boats or in these cases all stock prices. The late 90’s during the Dotcom bubble, the period after the great recession and to some degree the first quarter of 2012 are all examples.

A decent stock picker can make just as many good picks as a bad stock picker in a bull market. One of the skills that sets a great investor apart from the crowd is the ability to know when and how to diversify one’s assets. Knowing when to be invested is just as important as knowing when not to be invested.

Investing is not about trying to time the markets. At DWCM we focus on having a core foundation of assets around which to build a strategy, and then look for pockets of opportunities for investment. People can become their own worst enemy when it comes to investing, which is the basis for our case study this quarter.

Saturday, August 11, 2012

Buffalo Wild Wings Lays an Egg

So how do you weigh a growing company in revenue and profits against some strong headwinds such as rising commodities prices that make up your largest product sold? Welcome to the dilemma of owning Buffalo Wild Wings.

We own shares of BWLD in the DWCM Fund as well as holding positions in our client's accounts. Although positions are usually small this is a good example of holding some risk which could result in some outsized rewards.

The issue at hand is that food prices are going up which will likely cause pressure of BWLD profits. The feed inputs that go into growing chickens are on the rise this year due to the drought conditions in the US as well as a decrease in overall chicken supplies.

However, the management team at BWLD has weathered through this storm before.They have done so with the ability to pass on enough of the price increases onto it's customers without hurting sales. In addition BWLD has continued to expand it's operations with new store openings and solid comps at exiting restaurants.

This Barron's piece gives a bearish look at the stock. At DWCM we still believe in the growth story and that management will be able to manage through the headwinds. However this is a play for the risky part of one's portfolio.

We own shares of BWLD in the DWCM Fund as well as holding positions in our client's accounts. Although positions are usually small this is a good example of holding some risk which could result in some outsized rewards.

The issue at hand is that food prices are going up which will likely cause pressure of BWLD profits. The feed inputs that go into growing chickens are on the rise this year due to the drought conditions in the US as well as a decrease in overall chicken supplies.

However, the management team at BWLD has weathered through this storm before.They have done so with the ability to pass on enough of the price increases onto it's customers without hurting sales. In addition BWLD has continued to expand it's operations with new store openings and solid comps at exiting restaurants.

This Barron's piece gives a bearish look at the stock. At DWCM we still believe in the growth story and that management will be able to manage through the headwinds. However this is a play for the risky part of one's portfolio.

Week 32 Performance.....Climbing the wall of worry

Some times the economic climate does not align with the equity market climate. What I mean by this is that the economy could be tanking while the stock market rallies to all time highs. Or you have the opposite situation where the economy is humming along on all cylinders while the equity markets can't get out of their own way rushing to the down side.

I think that this is precisely the situation we have going on here in the US. Unexplicitly the stock market has been in rally mode for most of the summer while most economic data released has not been good. You also have an upcoming presidential election and the ultimate fiscal cliff. So is the market trying to tell us something that we don't know? Or are we blindly speeding down the road without seeing the sign that the bridge is out?

At DWCM we are leaning more towards the bridge being out than trying to figure out why the markets are rallying right now. This may put us into the larger camp with most people but we see it as being the most conservative while trying to protect clients' capital.

As we pointed out in last week's summary, this does not mean that we are either all in or all out of the market. Rather we are taking a balanced approached which means having some risk on the table but having more than enough capital on the sidelines in case the brakes don't work as we head towards the cliff.

Back in early July we had put out a post, Anyone Can Be An Economist. While getting groceries at my local super market last night I decided to do a little research. Over the past few weeks I had seen a subtle rise in food prices. Things like fruits, vegetables, and grains. I also noticed that store advertisements on sale items haven't been as beneficial to consumers as they had been in previous week. For example, a grain item that had been consistently advertised for months at 2 for $1 was now 2 for $1.50. Something about last nights trip around the isles caused me great concern.

It has been discussed previously how manipulated some of our government statistics can be such as inflation. Strip out food and energy prices and costs look tame or in some cases even lower. But the two items that most American depend upon every day aren't seeing a decline in prices but rather steep increases. Gas in MI where I reside jumped over $.30 in one week due to refinery issues in the Midwest. Californians are likely to be in the same boat as a major refinery fire there has limited capacity. We can already see where the impact of the drought is having an impact on food prices.

These are both headwinds that we did not expect and if something does not get resolved with the fiscal cliff issues at the end of the year it will drag the economy down even more. This is why we do not see the need to take on extra risk. We are positioning portfolios to take advantage of some opportunities that may present themselves if we are wrong. However we have portfolios, including the DWCM Fund, tilted more towards the conservative side in strong balance sheet stocks that pay good dividends and in agriculture companies.

In saying that, we cut back on two positions this week in the DWCM Fund in order to bolster our cash position. We would have either reduced or closed a few other positions but our price targets had not been met. We reduced the size of our second largest holding, The CME Group by 50% and educational software company K12 by almost 50% as well.

Overall the DWCM Fund has produced consistent returns over the summer months which is a feat in and of itself. Although we have trailed the major indices the past few weeks, we attribute this to our conservative management approach that we pointed out in the above commentary. Not to worry as we are still beating all four major benchmarks for the year.

The Week Ahead

Last week was extremely light with economic data but this week will provide a little more insight into the performance of the economy. We believe that retail sales, housing results, and the sentiment survey on Friday could be the real market drivers.

I think that this is precisely the situation we have going on here in the US. Unexplicitly the stock market has been in rally mode for most of the summer while most economic data released has not been good. You also have an upcoming presidential election and the ultimate fiscal cliff. So is the market trying to tell us something that we don't know? Or are we blindly speeding down the road without seeing the sign that the bridge is out?

At DWCM we are leaning more towards the bridge being out than trying to figure out why the markets are rallying right now. This may put us into the larger camp with most people but we see it as being the most conservative while trying to protect clients' capital.

As we pointed out in last week's summary, this does not mean that we are either all in or all out of the market. Rather we are taking a balanced approached which means having some risk on the table but having more than enough capital on the sidelines in case the brakes don't work as we head towards the cliff.

Back in early July we had put out a post, Anyone Can Be An Economist. While getting groceries at my local super market last night I decided to do a little research. Over the past few weeks I had seen a subtle rise in food prices. Things like fruits, vegetables, and grains. I also noticed that store advertisements on sale items haven't been as beneficial to consumers as they had been in previous week. For example, a grain item that had been consistently advertised for months at 2 for $1 was now 2 for $1.50. Something about last nights trip around the isles caused me great concern.

It has been discussed previously how manipulated some of our government statistics can be such as inflation. Strip out food and energy prices and costs look tame or in some cases even lower. But the two items that most American depend upon every day aren't seeing a decline in prices but rather steep increases. Gas in MI where I reside jumped over $.30 in one week due to refinery issues in the Midwest. Californians are likely to be in the same boat as a major refinery fire there has limited capacity. We can already see where the impact of the drought is having an impact on food prices.

These are both headwinds that we did not expect and if something does not get resolved with the fiscal cliff issues at the end of the year it will drag the economy down even more. This is why we do not see the need to take on extra risk. We are positioning portfolios to take advantage of some opportunities that may present themselves if we are wrong. However we have portfolios, including the DWCM Fund, tilted more towards the conservative side in strong balance sheet stocks that pay good dividends and in agriculture companies.

In saying that, we cut back on two positions this week in the DWCM Fund in order to bolster our cash position. We would have either reduced or closed a few other positions but our price targets had not been met. We reduced the size of our second largest holding, The CME Group by 50% and educational software company K12 by almost 50% as well.

Overall the DWCM Fund has produced consistent returns over the summer months which is a feat in and of itself. Although we have trailed the major indices the past few weeks, we attribute this to our conservative management approach that we pointed out in the above commentary. Not to worry as we are still beating all four major benchmarks for the year.

The Week Ahead

Last week was extremely light with economic data but this week will provide a little more insight into the performance of the economy. We believe that retail sales, housing results, and the sentiment survey on Friday could be the real market drivers.

- Mon - N/A

- Tue - NFIB Small Business Optimism Index, Producer Price Index, Retail Sales, Business Inventories

- Wed - Consumer Price Index, Empire State Mfg Survey, Industrial Production, Housing Market Index

- Thu - Housing Starts, Jobless Claims, Philadelphia Fed Survey

- Fri - Consumer Sentiment, Leading Indicators

Have a great week!

DreamWorks Capital Management

FREE LECTURE: Our next finance lecture will be on Tuesday September 18th at the The Community House. The topic will be Balancing Your Changing Investment Needs: Emergency Fund, Investments, Retirement, Education, and Philanthropy. We will cover significant points regarding creating, developing, and executing on your wealth management plan. We hope to have another interactive group, so be sure to sign up by emailing me directly at pfenner@dwcmllc.com or by contacting The Community House at 248-644-5832. There is no charge and light refreshments will be served.

FREE LECTURE: Our next finance lecture will be on Tuesday September 18th at the The Community House. The topic will be Balancing Your Changing Investment Needs: Emergency Fund, Investments, Retirement, Education, and Philanthropy. We will cover significant points regarding creating, developing, and executing on your wealth management plan. We hope to have another interactive group, so be sure to sign up by emailing me directly at pfenner@dwcmllc.com or by contacting The Community House at 248-644-5832. There is no charge and light refreshments will be served.

Subscribe to:

Posts (Atom)