With every jobs report comes largely to much emphasis on one data point. It is akin to giving the quarterback to much credit during a win and too much blame during a loss. The labor report is just one data point among many that can help people determine the direction of the economy. As in most cases these data points don't always align with each other. This is where people begin to exercise their own judgement and create their own assumptions regarding the economy.

So what does this labor data tell us along with the other economic data points released throughout the week? Not much. With some data good and some data bad it looks as though we will just continue to muddle along until either something bad happens or congress gets their act together.

As I was having a conversation with a client earlier this week, whomever wins the Presidential election in the US is not likely going to change the outcome of the current fiscal situation. Again like our quarterback analogy above, the President likely gets to much credit and too much blame for how the economy turns out. There is definitely a differing of philosophy when it comes to these two candidates but for whomever wins they are not likely going to be able to change our current course alone.

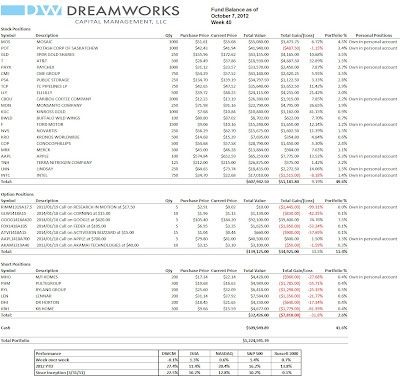

The DWCM fund suffered back to back weekly losses for the first time since the spring swoon back in April. Although the losses have been mild, they are losses nonetheless. The biggest contributor over the past two weeks has been the decline in Apple and the increase in the stock prices of the home builders.

We still have not found a satisfactory exit point for our short home builder positions. This has been a classic situation where what we believe long-term is not aligned with the short-term thinking of the markets. It boils down to how much pain you can take. Usually in a situation like this we would have exited the position once we started taking on losses. However, we believed in our strategy and stuck with it. We still believe in that strategy which is why we will likely hold on for another month and then reevaluate.

The Week Ahead

Monday is a US holiday for Columbus Day so the markets will be closed. The rest of the week is on the light side when it comes to economic data. With a long weekend ahead of us this is a great time to review possible investment scenarios and strategies to get you through the rest of the year. Expect the climate to be ever changing especially if the Presidential election tightens (although we downplay it's significance and if there is no movement on the US fiscal cliff issues while Europe continues to deal with their own debt crisis.

- Mon - US Markets closed for Columbus Day

- Tue - NFIB Small Business Optimism Index, ICSC-Goldman Store Sales

- Wed - Beige Book

- Thu - Jobless Claims

- Fri - Producer Price Index, Consumer Sentiment

Have a great week!

DreamWorks Capital Management

If you are currently trying to develop your own investment plan or are seeking the help of a professional investment advisor we urge you to give us the opportunity to show you what DWCM can do for you. No matter what stage in life you are currently at, DWCM can help you plan for your ever changing needs.

DWCM can you help you with any of the steps in your wealth management journey including;

- Addressing emergency fund needs and requirements

- Developing a retirement plan

- Sending a child to college

- Looking at various investment options

- Determining how to involve philanthropic passions as apart of your planning process

With our "SMART Principles", we can help you develop your unique goals and create a focused customized plan to achieve your financial and lifestyle goals.

Contact us at pfenner@dwcmllc.com.

No comments:

Post a Comment