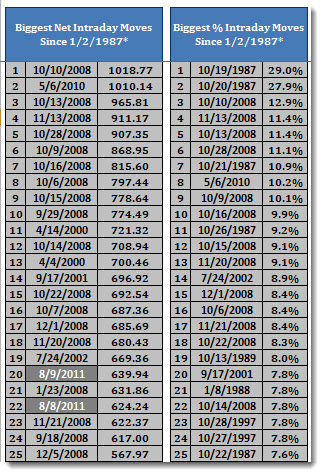

First are the biggest net intraday moves, only a couple since 1987 but notice all of the ones from the Fall/Winter of 2008

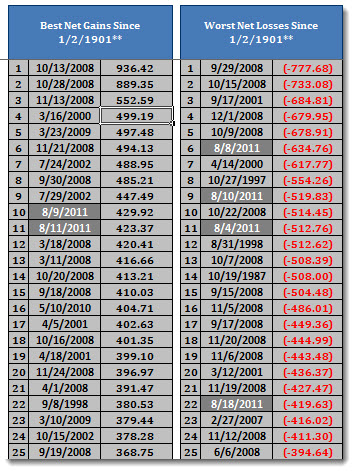

Next, best net gain/losses since 1901, getting warmer

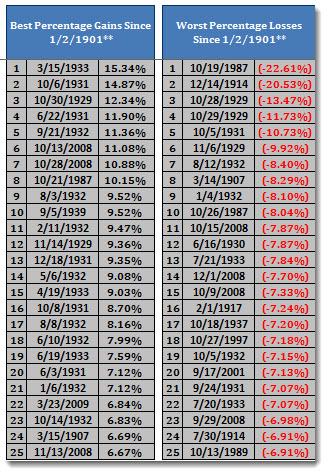

Finally Best/Worst % gains and loses since 1901. Surprisingly none but this is probably like to the absolute increase in size of the market. For example back in the 30's when the DOW trades in the hundreds it doesn't take much to really move the markets from a % point of view

No comments:

Post a Comment